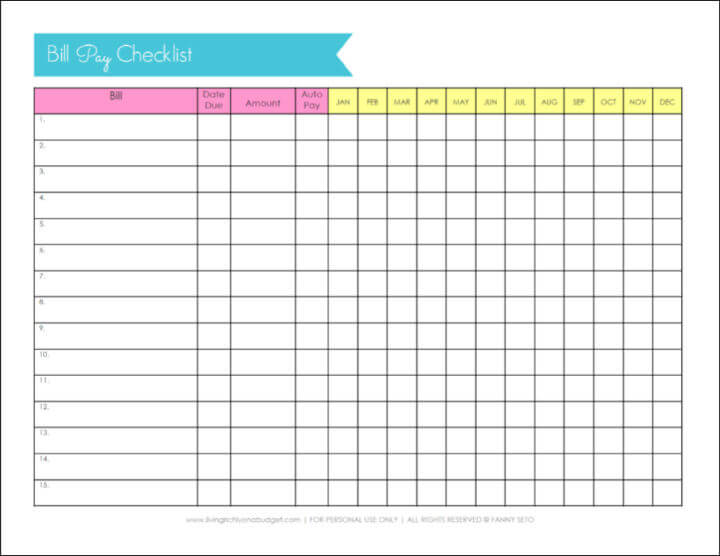

Bill Pay Checklist Free Printable: The Ultimate Guide to Financial Freedom

In the realm of personal finance, staying organized and on top of your bills can be a daunting task. However, with the right tools and strategies, you can streamline the bill-paying process and achieve financial freedom. One essential tool is a free printable bill pay checklist, which serves as a comprehensive guide to ensure you never miss a payment and avoid costly late fees.

This guide will delve into the components of an effective bill pay checklist, provide tips for customizing it to your specific needs, and share additional strategies for efficient bill management. By implementing these techniques, you’ll gain control over your finances, reduce stress, and enjoy peace of mind.

Bill Pay Checklist: Blagger’s Guide to Financial Finesse

Money management is a right of passage for all young adults. One of the most important aspects of managing your money is paying your bills on time. This can be a challenge, especially if you have a lot of bills to keep track of. That’s where a bill pay checklist comes in handy.

A bill pay checklist is a simple tool that can help you stay organized and make sure you never miss a payment. There are many different types of bill pay checklists available, so you can find one that fits your needs. Some checklists are designed to be used with a specific budgeting app, while others are more general. No matter which type of checklist you choose, the important thing is to use it consistently.

Benefits of Using a Bill Pay Checklist

- Keeps you organized and on top of your bills

- Helps you avoid late fees and penalties

- Improves your credit score

- Gives you peace of mind knowing that your bills are being paid on time

How to Use a Bill Pay Checklist

- Gather all of your bills together in one place.

- Create a bill pay checklist that includes the following information for each bill:

- Due date

- Amount due

- Payment method

- Review your checklist regularly and make sure that all of your bills are being paid on time.

- If you have any questions about your bills, contact your creditors directly.

Free Printable Bill Pay Checklist

If you’re looking for a free printable bill pay checklist, there are many available online. You can also create your own checklist using a spreadsheet or word processing program.

Questions and Answers

What are the benefits of using a bill pay checklist?

A bill pay checklist helps you stay organized, avoid late payments, prioritize bills, and track your spending.

How do I prioritize bills on my checklist?

Prioritize essential bills such as rent, mortgage, utilities, and credit card payments. Consider the due dates and amounts due when prioritizing.

Can I customize my bill pay checklist?

Yes, you can add or remove categories, change the layout, and adjust the checklist to fit your specific needs and preferences.