IRS Form 4868 Printable: A Comprehensive Guide for Taxpayers

Navigating the complexities of tax filing can be a daunting task, but with the right tools, it doesn’t have to be. IRS Form 4868 Printable is an essential document that simplifies the process for taxpayers. This comprehensive guide will provide you with all the necessary information to download, complete, and utilize this form effectively.

Whether you’re a seasoned tax professional or a first-time filer, this guide will empower you to understand the purpose, benefits, and proper usage of IRS Form 4868 Printable. We’ll delve into step-by-step instructions, real-world examples, and expert tips to ensure your tax filing experience is smooth and efficient.

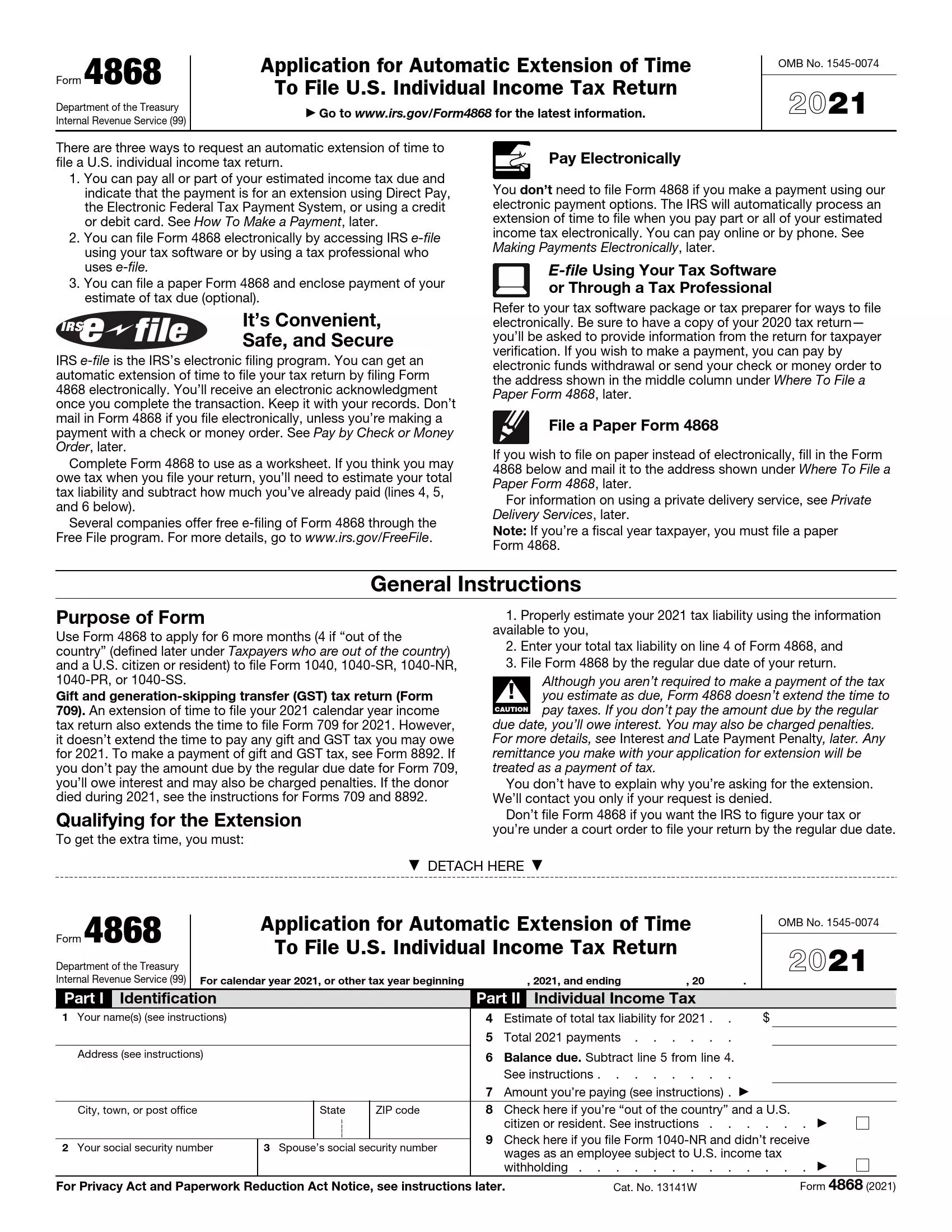

Irs Form 4868 Printable

The Irs Form 4868 Printable is a tax form that you can use to apply for an extension of time to file your income tax return. It’s a simple form to fill out, and it can be a lifesaver if you need more time to get your taxes done.

Who Should Use Irs Form 4868 Printable?

You should use Irs Form 4868 Printable if you need more time to file your income tax return. You can use this form to request an extension of up to 6 months.

How to Fill Out Irs Form 4868 Printable?

To fill out Irs Form 4868 Printable, you will need to provide your personal information, your tax information, and the reason why you need an extension.

You can find the Irs Form 4868 Printable on the IRS website.

What Happens After You File Irs Form 4868 Printable?

After you file Irs Form 4868 Printable, the IRS will review your request and make a decision. If your request is approved, you will receive a notice from the IRS that grants you an extension of time to file your income tax return.

FAQs

Q: What is the purpose of IRS Form 4868 Printable?

A: IRS Form 4868 Printable is a fillable PDF document used to apply for an extension of time to file various tax returns, including individual income tax returns, business tax returns, and estate and gift tax returns.

Q: What are the benefits of using the printable version of IRS Form 4868?

A: The printable version offers several benefits, including convenience, flexibility, and cost savings. You can download and print the form at your leisure, fill it out at your own pace, and avoid the need for postage or delivery fees.

Q: How do I fill out IRS Form 4868 Printable accurately?

A: To ensure accuracy, follow the instructions provided on the form carefully. Provide clear and concise information, including your personal details, tax year, and the specific reason for requesting an extension.

Q: What are some common mistakes to avoid when filling out IRS Form 4868 Printable?

A: Common mistakes include providing incomplete or incorrect information, failing to sign and date the form, and requesting an extension beyond the allowable time frame.

Q: Where can I get professional help if needed?

A: If you encounter difficulties or have complex tax situations, you can seek professional assistance from a tax advisor, accountant, or enrolled agent.