Mastering M&A Agreements with Comprehensive Templates

In the dynamic realm of mergers and acquisitions, navigating the complexities of legal agreements is paramount. M&A agreement templates offer a valuable tool to streamline this process, ensuring both efficiency and effectiveness.

This comprehensive guide will delve into the world of M&A agreement templates, empowering you with a deep understanding of their purpose, key provisions, and best practices. From drafting and negotiating to legal considerations and emerging trends, we will explore every aspect to equip you for success in this critical area of business transactions.

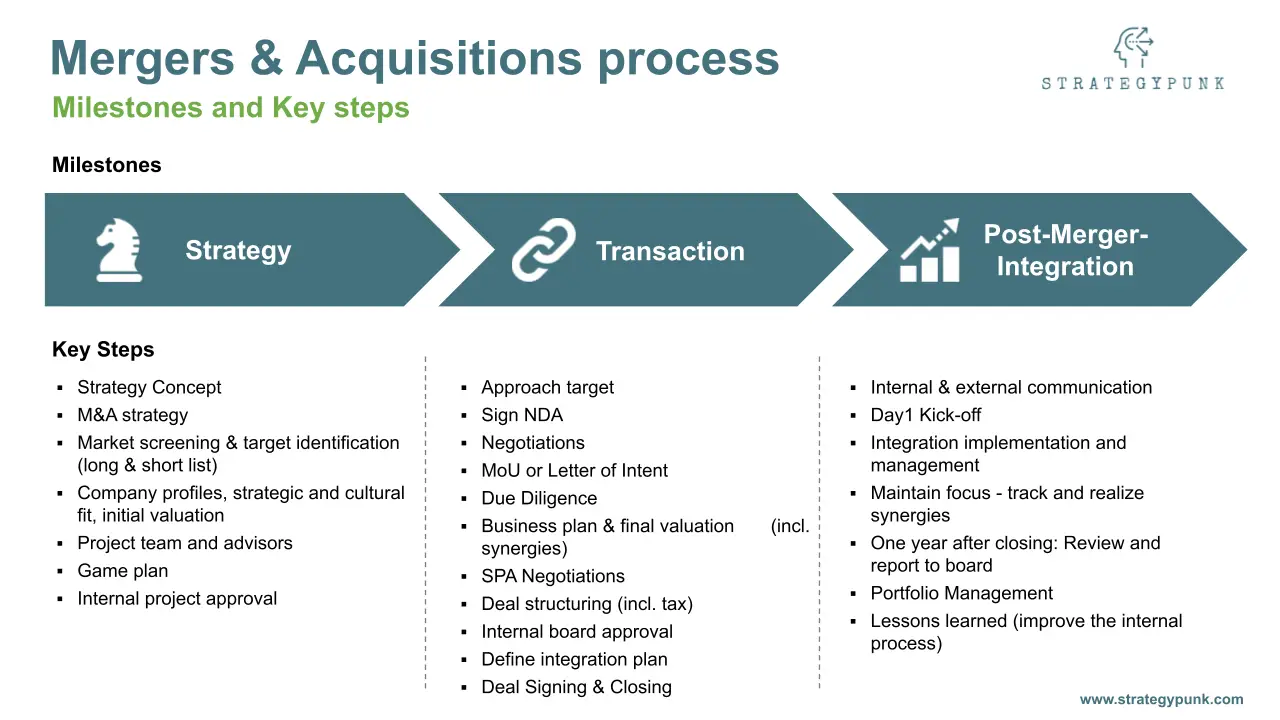

Overview of M&A Agreement Templates

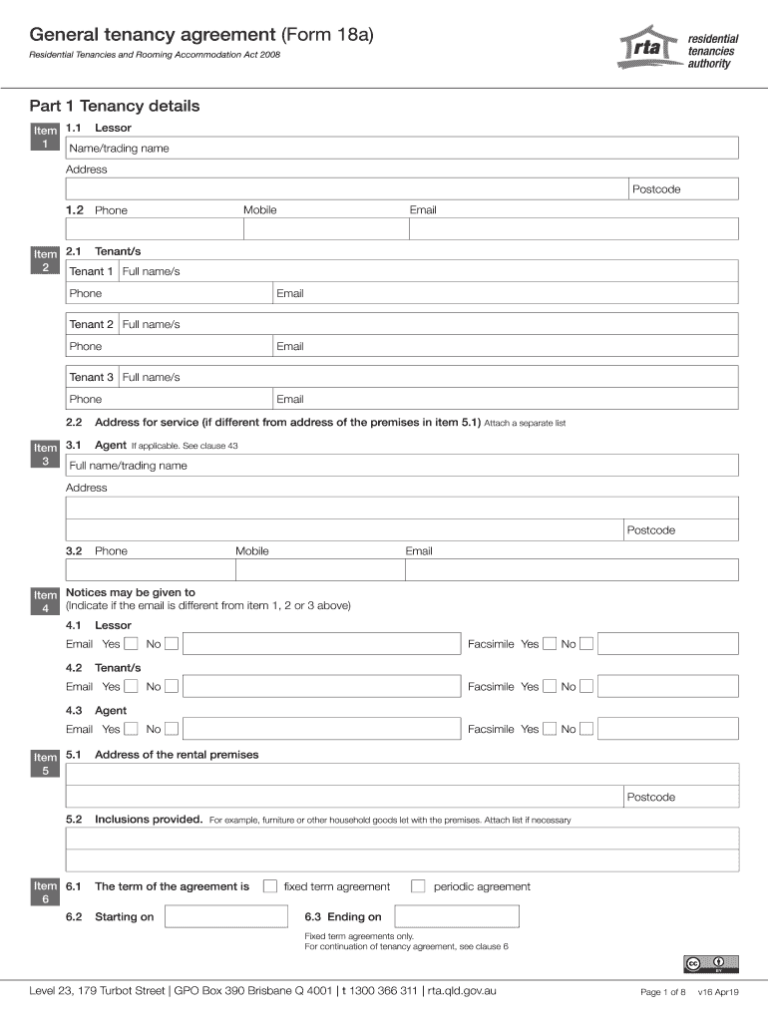

An M&A agreement template is a pre-drafted legal document that provides a framework for the terms and conditions of a merger or acquisition transaction. Using a template streamlines the process, ensures compliance with legal requirements, and facilitates efficient negotiations between the parties involved.

Common types of M&A agreement templates include:

- Merger Agreement: Artikels the terms of a merger, including the exchange ratio of shares, the surviving entity, and the governance structure.

- Acquisition Agreement: Defines the purchase price, payment terms, and conditions for the acquisition of one company by another.

- Asset Purchase Agreement: Specifies the specific assets being acquired, the purchase price, and the conditions for the transfer of ownership.

Key Provisions of an M&A Agreement Template

Innit, an M&A agreement template is like a blueprint for your merger or acquisition. It’s got all the essential bits and bobs you need to make sure your deal goes down smoothly. But what are these key provisions, and why are they so important?

Well, let’s break it down, fam. Here’s the lowdown on the must-have provisions in an M&A agreement template:

Representations and Warranties

These are like promises made by both sides. They’re basically saying, “We’re not hiding anything dodgy, and everything we’ve told you is the truth.” These warranties are crucial because they give you a bit of protection if it turns out your new biz isn’t all it’s cracked up to be.

Covenants

These are like rules that both sides have to follow before and after the deal goes through. They might cover things like not selling off any assets or hiring any new staff without the other side’s permission. Covenants make sure that neither side gets up to any funny business during the transition.

Conditions Precedent

These are like hurdles that have to be jumped before the deal can close. They might include things like getting approval from the competition authorities or sorting out any outstanding legal issues. Conditions precedent protect both sides by making sure that everything is in order before the deal goes through.

Drafting and Negotiating an M&A Agreement Using a Template

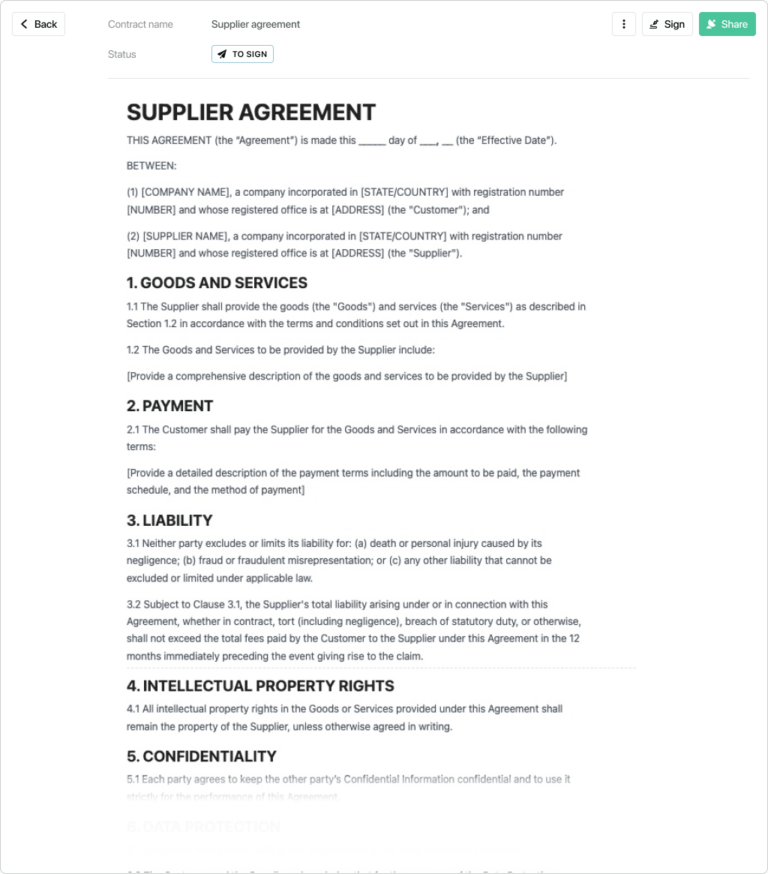

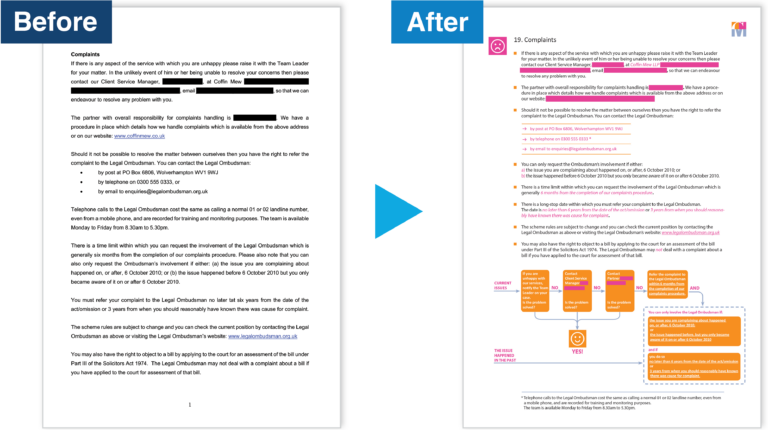

Using a template for drafting an M&A agreement offers several advantages. It saves time and effort, ensures consistency, and provides a starting point for negotiations. However, there are also some potential drawbacks to using a template, such as the risk of overlooking important issues or including provisions that are not relevant to the specific transaction.

To effectively negotiate an M&A agreement based on a template, it is important to understand the key provisions of the agreement and to be prepared to discuss and negotiate each provision in detail. It is also important to be aware of the potential pitfalls of using a template and to take steps to avoid them.

Customizing and Tailoring the Template to Specific Transaction Needs

Once a template has been selected, it is important to customize and tailor it to the specific transaction needs. This may involve adding or removing provisions, modifying the language of the agreement, and negotiating specific terms and conditions.

-

Add or Remove Provisions:

The template may not include all of the provisions that are necessary for the specific transaction. For example, the template may not include provisions for the transfer of intellectual property or for the assumption of liabilities. It is important to review the template carefully and to identify any provisions that need to be added. -

Modify the Language of the Agreement:

The language of the template may not be appropriate for the specific transaction. For example, the template may use legal jargon that is not familiar to the parties involved. It is important to modify the language of the agreement so that it is clear and understandable to all parties. -

Negotiate Specific Terms and Conditions:

The template may not include specific terms and conditions that are important to the parties involved. For example, the template may not specify the purchase price or the closing date. It is important to negotiate specific terms and conditions that are acceptable to all parties.

Legal Considerations and Best Practices

Using an M&A agreement template offers convenience, but it’s crucial to be aware of potential legal pitfalls. Identifying these issues helps ensure the validity and enforceability of your agreement.

Identifying Potential Legal Pitfalls

– Inadequate due diligence: Templates may not cover all legal aspects, leading to oversights that could impact the transaction’s validity.

– Ambiguous or incomplete clauses: Unclear language or missing provisions can create loopholes or disputes.

– Unenforceable terms: Certain clauses may be unenforceable due to public policy or statutory requirements.

– Conflict with existing agreements: Templates may not consider existing contracts or legal obligations, leading to potential conflicts.

Best Practices for Validity and Enforceability

– Seek legal advice: Consult an experienced M&A attorney to review the template and identify any potential issues.

– Tailor the template to the transaction: Customize the template to reflect the specific details and circumstances of your transaction.

– Negotiate and clarify terms: Engage in thorough negotiations to ensure that all terms are clearly defined and agreed upon.

– Document all changes: Keep a record of any modifications or additions made to the template to avoid future disputes.

– Obtain necessary approvals: Ensure that all necessary approvals, such as shareholder or regulatory approvals, are obtained before executing the agreement.

Emerging Trends and Innovations in M&A Agreement Templates

M&A agreement templates are constantly evolving to reflect the changing legal and business landscape. In recent years, we have seen a number of emerging trends and innovations in the use of these templates.

Technology and Automation

One of the most significant trends is the increasing use of technology and automation in the drafting and negotiation of M&A agreements. This is being driven by the need for greater efficiency and accuracy in the M&A process.

For example, there are now a number of software programs that can be used to draft and negotiate M&A agreements. These programs can automate many of the tasks that were previously done manually, such as drafting clauses and checking for errors. This can save a significant amount of time and effort, and can help to ensure that the final agreement is accurate and complete.

Artificial Intelligence

Another emerging trend is the use of artificial intelligence (AI) in the M&A process. AI can be used to analyze large amounts of data and identify patterns and trends. This can help to inform decision-making and can make the M&A process more efficient and effective.

For example, AI can be used to identify potential target companies, to assess the risks and benefits of a particular transaction, and to negotiate the terms of an agreement. This can help to ensure that the M&A process is based on sound data and analysis, and can increase the chances of a successful outcome.

Future of M&A Agreement Templates

The future of M&A agreement templates is likely to be characterized by continued innovation and the adoption of new technologies. We can expect to see even greater use of automation and AI in the M&A process, as well as the development of new tools and templates that can help to make the process more efficient and effective.

FAQ Section

What is an M&A agreement template?

An M&A agreement template is a standardized legal document that provides a framework for drafting and negotiating mergers and acquisition agreements. It includes essential provisions and clauses that address the key legal and commercial aspects of the transaction.

What are the advantages of using an M&A agreement template?

Using an M&A agreement template offers several advantages, including saving time and effort in drafting, ensuring consistency and completeness, and reducing the risk of legal errors or omissions.

When should I consider using an M&A agreement template?

M&A agreement templates are particularly useful in situations where time is of the essence, the transaction is relatively straightforward, or there is a need for standardization across multiple agreements.

Are there any potential drawbacks to using an M&A agreement template?

While M&A agreement templates provide a valuable starting point, it’s important to note that they may not be suitable for all transactions. Complex or highly customized agreements may require significant modifications to the template, potentially negating its benefits.