Free Loan Agreement Templates: A Comprehensive Guide to Understanding and Utilizing Them

In the realm of finance, loan agreements serve as crucial legal documents that Artikel the terms and conditions governing the lending and repayment of funds. Whether you’re an individual seeking a personal loan or a business owner navigating commercial financing, a well-drafted loan agreement is paramount to protect the interests of all parties involved.

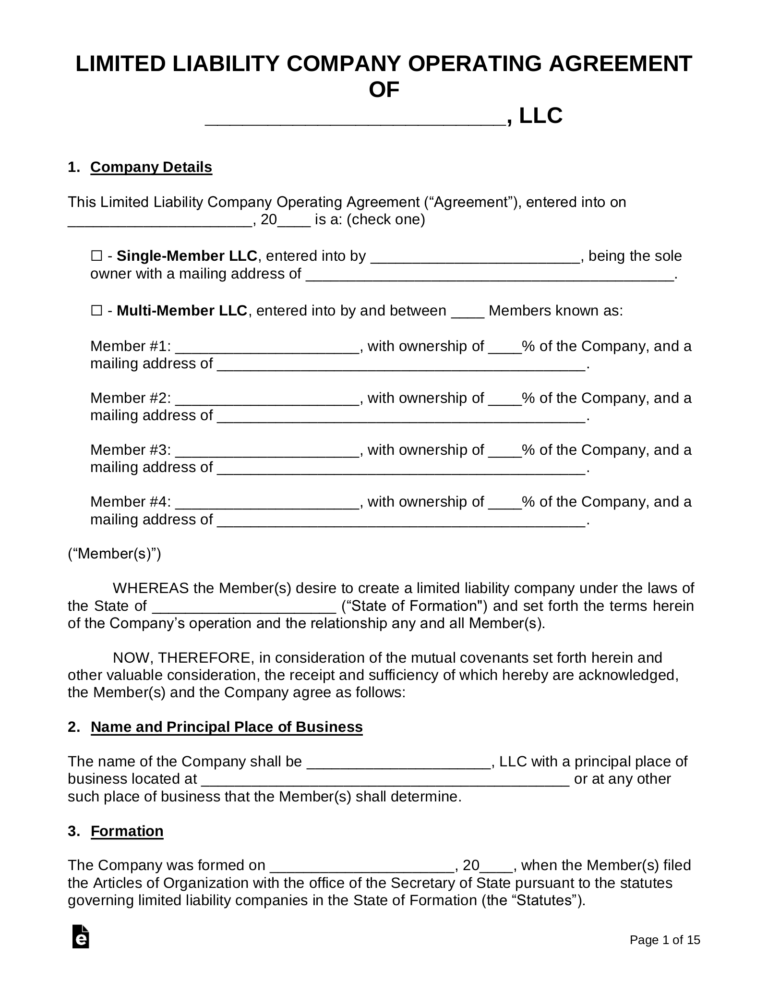

Fortunately, there are numerous free loan agreement templates available online, providing a convenient and cost-effective solution for individuals and businesses alike. These templates offer a structured framework to ensure that all essential aspects of the loan are clearly defined and legally binding.

How to Find and Use Free Loan Agreement Templates

Finding and using free loan agreement templates can be a convenient and cost-effective way to create a legally binding agreement between you and the person you are lending money to. Here are a few tips on how to find and use free loan agreement templates:

Search online for free loan agreement templates

There are many websites that offer free loan agreement templates. You can simply search for “free loan agreement template” in your favorite search engine and you will be presented with a number of options.

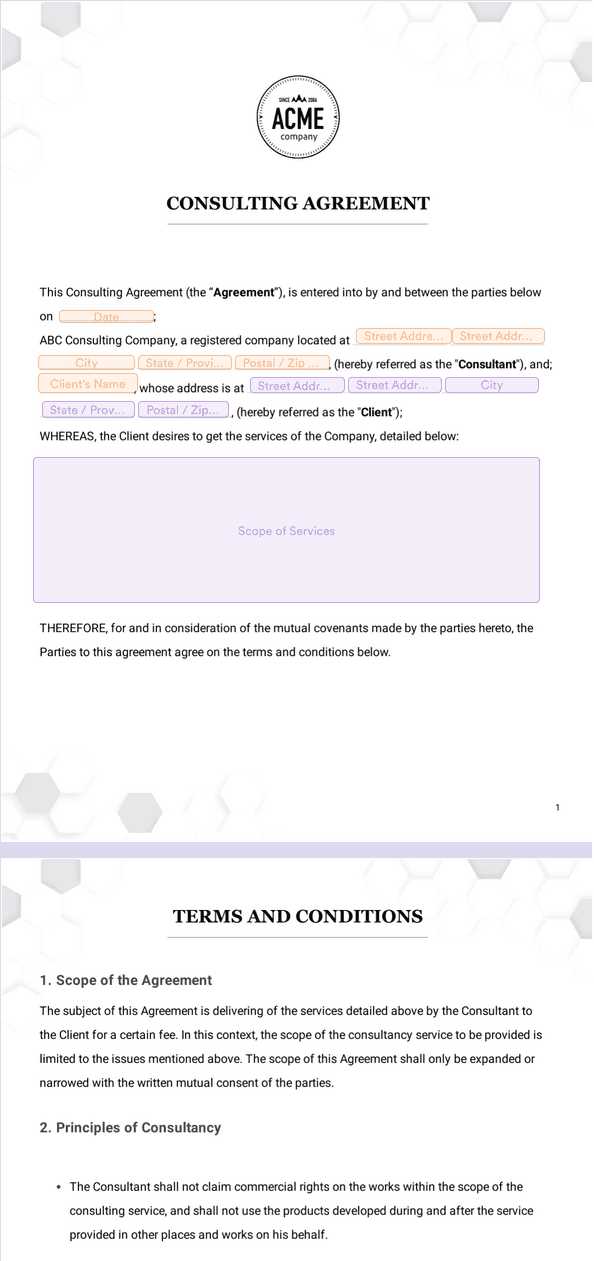

Use legal document websites

Legal document websites often offer free loan agreement templates. These websites typically have a variety of templates to choose from, so you can find one that meets your specific needs.

Consult with an attorney

If you are not comfortable using a free loan agreement template, you can consult with an attorney. An attorney can help you create a loan agreement that is tailored to your specific needs.

Read the template carefully before using it

Before you use a free loan agreement template, it is important to read it carefully and make sure that you understand all of the terms and conditions. You should also make sure that the template is up-to-date and that it complies with the laws of your state.

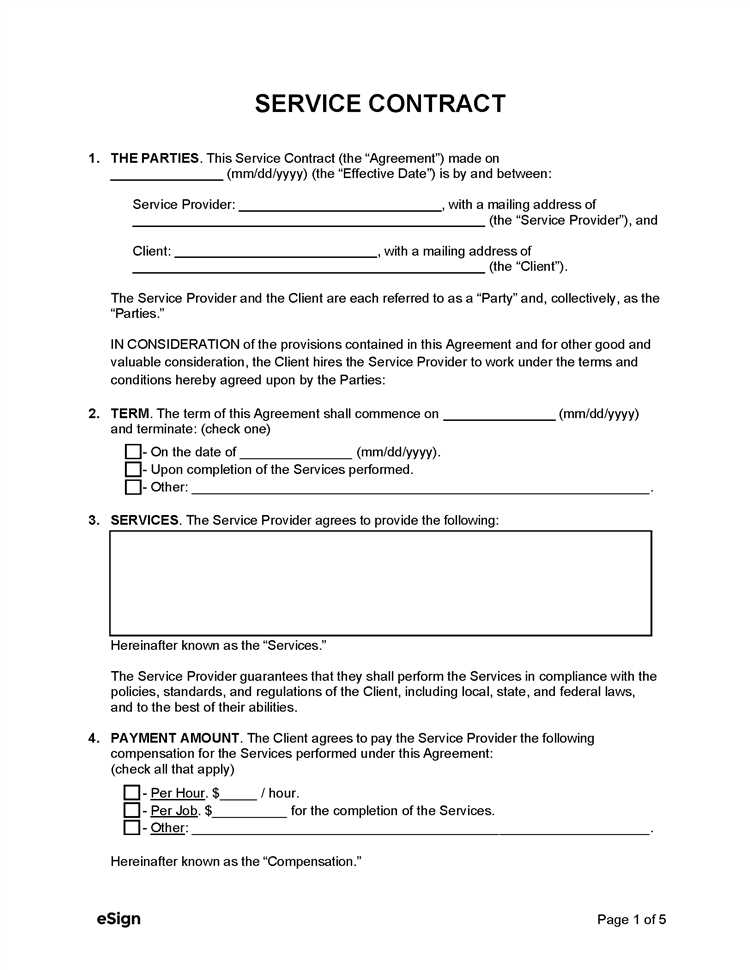

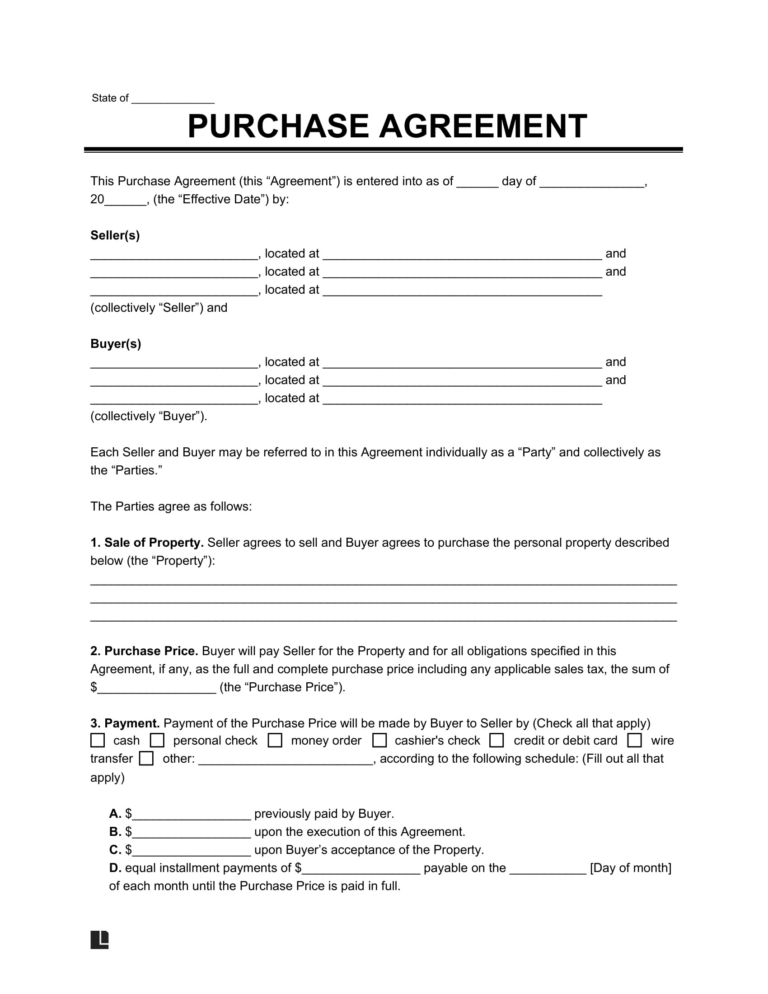

Customize the template to fit your specific needs

Once you have found a free loan agreement template that you like, you can customize it to fit your specific needs. You can add or remove provisions, and you can change the language to make it more clear and concise.

Tips for Drafting a Loan Agreement

A loan agreement is a legally binding contract that sets out the terms of a loan between two parties. It is important to make sure that the agreement is clear and concise, and that it includes all of the essential terms of the loan.

Here are some tips for drafting a loan agreement:

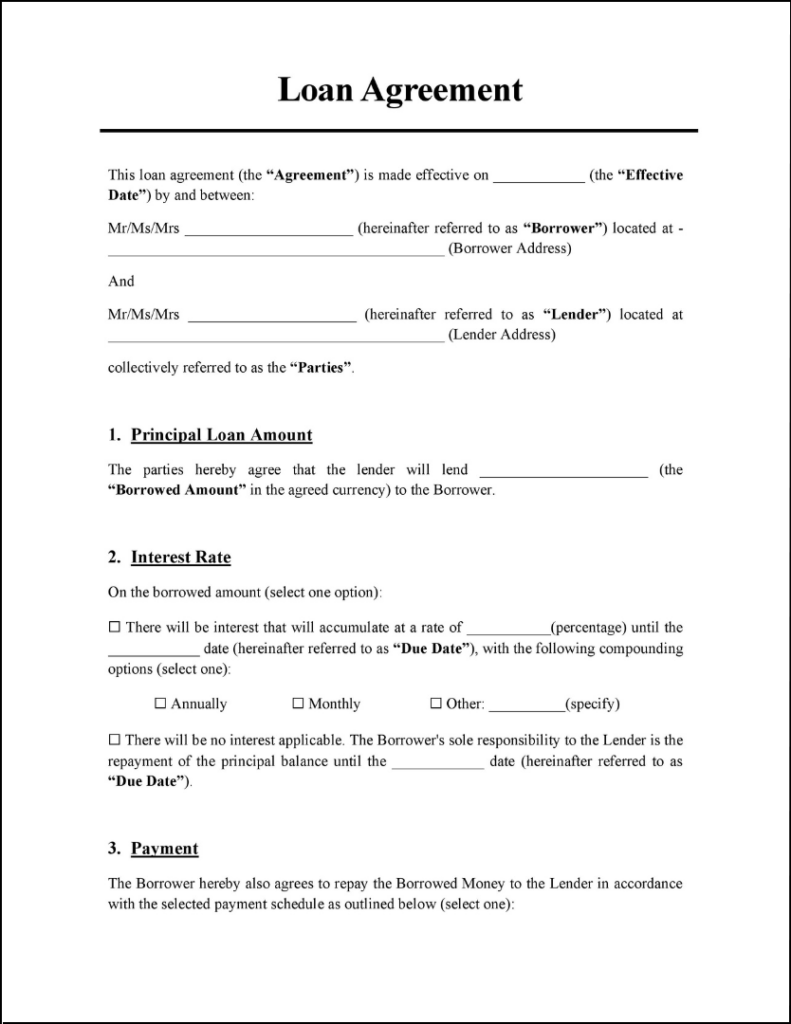

Include all essential terms of the loan

The loan agreement should include the following information:

- The amount of the loan

- The interest rate

- The repayment schedule

- The security (if any)

- The default provisions

Make sure the agreement is clear and concise

The loan agreement should be written in clear and concise language that is easy to understand. Avoid using legal jargon or technical terms that the borrower may not be familiar with.

Use plain language that is easy to understand

The loan agreement should be written in plain language that is easy to understand. Avoid using legal jargon or technical terms that the borrower may not be familiar with.

Have the agreement reviewed by an attorney

Before you sign the loan agreement, it is a good idea to have it reviewed by an attorney. An attorney can help you to make sure that the agreement is fair and that it protects your interests.

Alternatives to Free Loan Agreement Templates

Innit, if you’re not down with using a free loan agreement template, you’ve got a few other options, fam.

Hire an attorney to draft a custom loan agreement

Hiring a lawyer to sort out your loan agreement is like getting a pro footballer to coach your Sunday league team – they know their stuff and will make sure everything’s watertight. Of course, it’s not gonna be cheap, so brace yourself for some legal fees.

Use a paid loan agreement service

These online services are like the middle ground between free templates and hiring a lawyer. They’ll hook you up with a loan agreement that’s tailored to your needs, but it’ll still cost you some dough. The upside is that it’s usually cheaper than hiring a lawyer.

Create your own loan agreement from scratch

If you’re feeling brave, you can always try to draft your own loan agreement. Just be warned, it’s not as easy as it looks. You need to make sure you cover all the legal bases and that the agreement is fair to both parties. If you’re not confident in your legal skills, it’s best to stick with one of the other options.

Q&A

What are the key benefits of using free loan agreement templates?

Free loan agreement templates offer numerous advantages, including saving time and effort, ensuring legal bindingness, protecting the interests of both parties, and minimizing the risk of potential disputes.

Where can I find free loan agreement templates?

You can find free loan agreement templates through various channels, such as searching online, utilizing legal document websites, or consulting with an attorney.

Is it advisable to customize the loan agreement template to fit my specific needs?

Yes, it is highly recommended to customize the loan agreement template to reflect the unique circumstances and requirements of your specific loan agreement.