Agreement Form for Loan: A Comprehensive Guide to Understanding and Drafting

In the realm of finance, loan agreements serve as indispensable tools that define the terms and conditions governing the borrowing and lending of funds. An Agreement Form for Loan provides a structured framework that Artikels the rights, obligations, and expectations of both parties involved. This comprehensive guide delves into the intricacies of loan agreement forms, empowering individuals with the knowledge to navigate this crucial aspect of financial transactions.

Loan agreement forms play a pivotal role in safeguarding the interests of both borrowers and lenders. They establish clear expectations, minimize misunderstandings, and provide a legal foundation for enforcing the terms of the loan. By understanding the essential elements, legal considerations, and different types of loan agreement forms, individuals can effectively protect their financial interests and ensure a smooth loan process.

Overview of Loan Agreement Forms

A loan agreement form is a legal document that Artikels the terms and conditions of a loan between a borrower and a lender. It serves as a binding contract, ensuring that both parties understand and agree to the loan’s details, including the loan amount, interest rate, repayment schedule, and any other relevant provisions.

Loan agreement forms are crucial because they protect the rights and interests of both the borrower and the lender. They provide a clear understanding of the loan’s terms, preventing misunderstandings or disputes in the future. By signing a loan agreement form, both parties acknowledge and accept the obligations and responsibilities associated with the loan.

Purpose of a Loan Agreement Form

- Artikels the loan’s terms and conditions, including the loan amount, interest rate, repayment schedule, and any other relevant provisions.

- Protects the rights and interests of both the borrower and the lender.

- Provides a clear understanding of the loan’s terms, preventing misunderstandings or disputes in the future.

- Ensures that both parties acknowledge and accept the obligations and responsibilities associated with the loan.

Importance of a Loan Agreement Form

- Legally binding contract that Artikels the terms and conditions of the loan.

- Protects both parties from misunderstandings or disputes.

- Provides a clear record of the loan’s terms, which can be referred to in case of any future disagreements.

- Helps to ensure that the loan is repaid according to the agreed-upon terms.

Essential Elements of a Loan Agreement Form

Signing a loan agreement is like making a solemn pact. It’s a legally binding document that Artikels the terms and conditions you and the lender have agreed upon. To make sure everyone’s on the same page, a loan agreement form should include some essential elements. Let’s dive into what they are and why they matter.

Parties Involved

First off, it’s crucial to clearly identify the parties involved in the loan. This includes the borrower (that’s you, mate) and the lender (the one lending you the dough). Their names, addresses, and contact information should be spelled out nice and clear.

Loan Amount and Terms

Next up, you need to nail down the nitty-gritty details of the loan. This includes the amount you’re borrowing, the interest rate, the repayment schedule, and the loan term (how long you have to pay it back). Make sure you understand these terms thoroughly before you sign on the dotted line.

Security

In some cases, the lender might ask for collateral to secure the loan. This could be anything from your car to your house. If you default on the loan, the lender can seize the collateral to cover their losses.

Default and Remedies

Life can throw curveballs, so it’s important to have a plan in place in case you can’t repay the loan as agreed. The loan agreement should Artikel what happens if you default, such as late fees, penalties, or even foreclosure.

Governing Law and Dispute Resolution

To avoid any legal headaches, the loan agreement should specify which laws govern the contract and how disputes will be resolved. This is especially important if you’re borrowing money from a lender in a different country.

Signatures

Last but not least, both you and the lender need to sign and date the loan agreement. This shows that you’ve both agreed to the terms and conditions Artikeld in the document.

Legal Considerations for Loan Agreement Forms

Signing a loan agreement form is a legally binding contract that creates obligations for both the borrower and the lender. It’s crucial to understand the legal implications of these forms before putting pen to paper.

A loan agreement form Artikels the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions. These terms are legally enforceable, and failure to comply with them can result in serious consequences, such as default or legal action.

Importance of Legal Advice

Given the legal significance of loan agreement forms, it’s highly advisable to consult with a legal professional before signing one. An experienced solicitor can review the form, explain its terms in plain English, and advise you on your rights and obligations.

Legal advice can help you avoid signing an agreement that is unfair or disadvantageous. It can also protect you from potential legal disputes down the line.

Different Types of Loan Agreement Forms

Loan agreement forms vary depending on the type of loan and the lender. Some common types of loan agreement forms include:

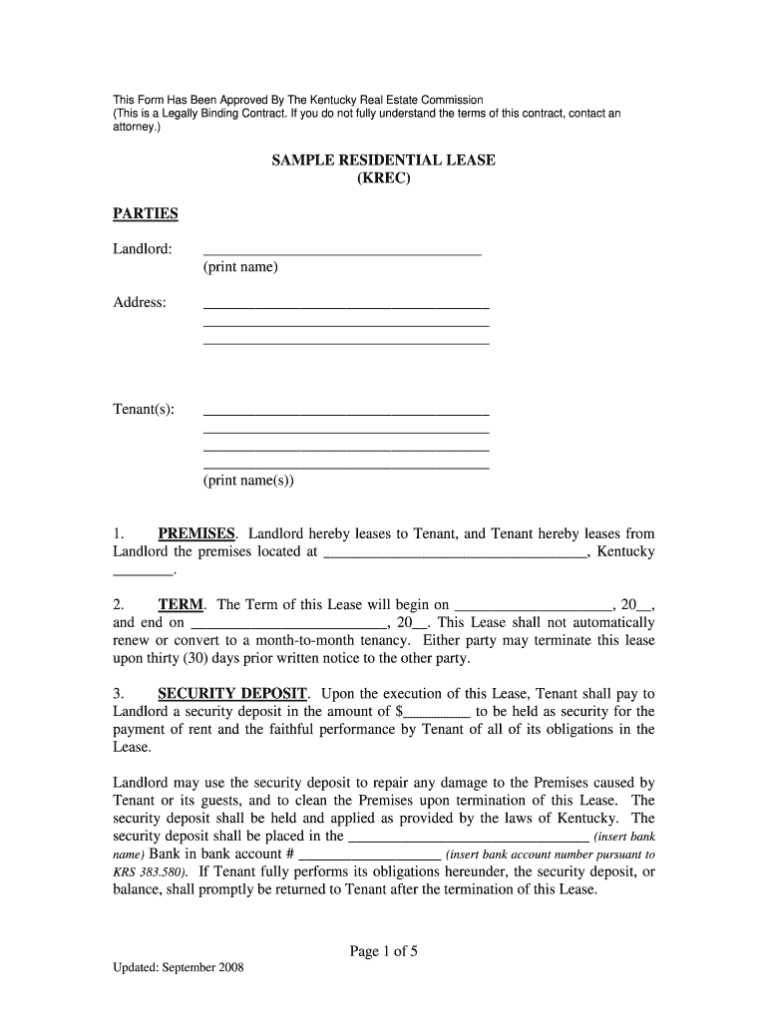

Secured Loan Agreement Form

A secured loan agreement form is used for loans that are backed by collateral, such as a car or a house. The collateral secures the loan, which means that if the borrower defaults on the loan, the lender can seize the collateral.

Unsecured Loan Agreement Form

An unsecured loan agreement form is used for loans that are not backed by collateral. These loans are typically more expensive than secured loans because the lender is taking on more risk.

Personal Loan Agreement Form

A personal loan agreement form is used for loans that are made to individuals for personal use, such as a car loan or a credit card loan.

Business Loan Agreement Form

A business loan agreement form is used for loans that are made to businesses. These loans can be used for a variety of purposes, such as expanding the business or purchasing new equipment.

Mortgage Loan Agreement Form

A mortgage loan agreement form is used for loans that are used to purchase real estate. These loans are typically long-term loans with fixed interest rates.

Drafting a Loan Agreement Form

Crafting a loan agreement form is a crucial step in securing a loan. Here’s a guide to help you navigate the process effectively.

To draft a clear and effective loan agreement form, follow these steps:

Steps Involved

- Identify the parties involved: Determine the lender and borrower and their respective roles.

- State the loan amount and terms: Specify the loan amount, interest rate, repayment schedule, and any applicable fees.

- Define the security: Artikel any collateral or security provided by the borrower to secure the loan.

- Include default provisions: Stipulate the consequences if the borrower fails to meet their obligations.

- Set out dispute resolution mechanisms: Establish how any disputes will be resolved.

Tips and Best Practices

- Use clear and concise language: Ensure the agreement is easy to understand.

- Seek legal advice: Consult a lawyer to ensure the agreement is legally sound.

- Proofread carefully: Check for any errors or omissions before signing.

- Keep a copy for your records: Retain a copy of the signed agreement for future reference.

Negotiating and Finalizing a Loan Agreement Form

Negotiating a loan agreement form involves discussing and reaching an agreement on the terms of the loan, such as the interest rate, repayment schedule, and security. It’s crucial to carefully review the form and seek legal advice if necessary.

Strategies for Negotiating Favorable Terms

* Prepare thoroughly: Gather all relevant information, such as your financial situation and the lender’s loan options.

* Start early: Initiate negotiations as soon as possible to allow ample time for discussion.

* Be specific: Clearly state your desired terms and provide justification for your requests.

* Be willing to compromise: It’s unlikely you’ll get everything you want, so be prepared to negotiate and find a mutually acceptable solution.

* Consider the long-term: Don’t focus solely on the immediate benefits; consider the potential impact of the loan on your future financial situation.

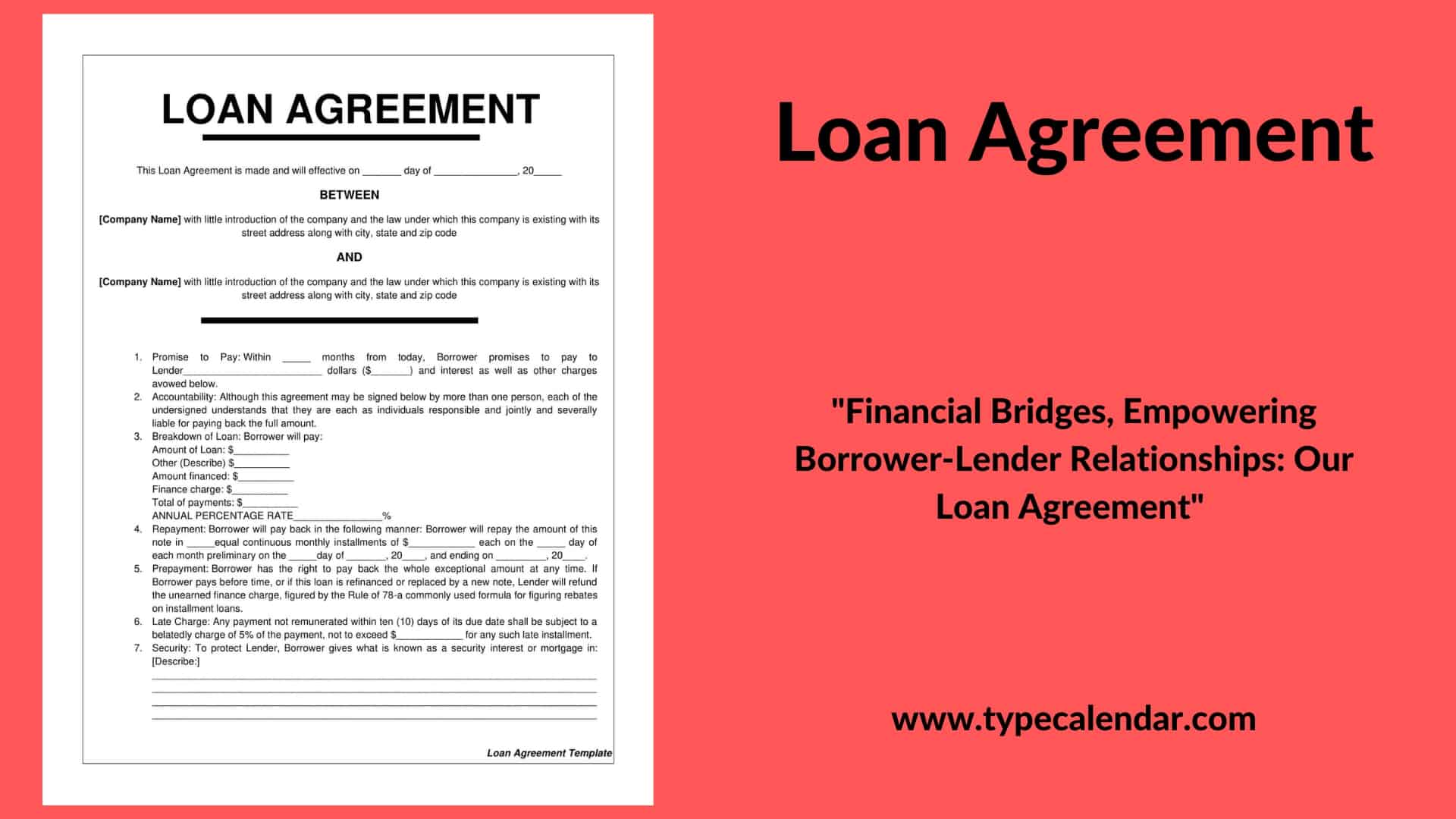

Sample Loan Agreement Forms

Loan agreement forms serve as legally binding contracts that Artikel the terms and conditions of a loan between a lender and a borrower. These forms can vary in complexity and length depending on the nature of the loan and the specific requirements of the parties involved. However, all well-drafted loan agreement forms share certain key elements and provisions that ensure clarity, fairness, and enforceability.

Examples of Loan Agreement Forms

Numerous online resources provide access to sample loan agreement forms. These forms can be customized to suit the specific needs of the parties involved. Some popular websites offering sample loan agreement forms include:

- The Law Depot: https://www.lawdepot.com/contracts/loan-agreement/

- LegalZoom: https://www.legalzoom.com/contracts/loan-agreement

- Rocket Lawyer: https://www.rocketlawyer.com/documents/loan-agreement

It’s important to note that these sample forms are not intended to be used as legal advice. It’s always advisable to consult with a qualified attorney to review and finalize any loan agreement form before signing.

Key Elements and Provisions of Sample Forms

Well-drafted loan agreement forms typically include the following key elements and provisions:

- Parties to the Agreement: This section identifies the lender and the borrower.

- Loan Amount: This section specifies the amount of money being loaned.

- Interest Rate: This section Artikels the interest rate that will be charged on the loan.

- Loan Term: This section specifies the duration of the loan.

- Repayment Schedule: This section Artikels the schedule for repaying the loan, including the amount of each payment and the due date.

- Security: This section Artikels any collateral or security that is being provided to secure the loan.

- Default Provisions: This section Artikels the consequences of defaulting on the loan, such as late fees, acceleration of the loan, and foreclosure.

- Governing Law: This section specifies the governing law that will apply to the loan agreement.

By carefully reviewing and understanding the key elements and provisions of a loan agreement form, borrowers can ensure that they fully understand the terms and conditions of the loan and are making an informed decision before signing.

Online Resources for Loan Agreement Forms

Accessing loan agreement forms online can be convenient, but it’s crucial to use reliable sources. Here are some popular options:

Websites

– Legal Forms: Provides a wide range of legal forms, including loan agreements, reviewed by attorneys.

– Rocket Lawyer: Offers customizable loan agreement templates and legal advice from licensed attorneys.

– Nolo: A reputable publisher of legal resources, including loan agreement forms and guidance.

Reliability and Trustworthiness

The reliability and trustworthiness of these resources vary. Legal Forms and Rocket Lawyer are established companies with legal expertise, making them generally reliable. Nolo is also a well-known publisher with a strong reputation.

However, it’s always advisable to carefully review the terms and conditions of any loan agreement form before signing it. If you have any concerns or need personalized advice, consider consulting an attorney.

FAQ Summary

What is the purpose of an Agreement Form for Loan?

An Agreement Form for Loan Artikels the terms and conditions of a loan, including the loan amount, interest rate, repayment schedule, and other relevant details. It serves as a legal document that protects the rights and interests of both the borrower and the lender.

What are the key elements of an Agreement Form for Loan?

Key elements of an Agreement Form for Loan include the names of the borrower and lender, the loan amount, the interest rate, the repayment schedule, the loan term, and any collateral or security involved.

Why is it important to consult with a legal professional before signing a Loan Agreement Form?

Consulting with a legal professional before signing a Loan Agreement Form ensures that you fully understand the terms and conditions of the loan and your legal obligations. It also helps you identify any potential risks or concerns and negotiate favorable terms.

What are the different types of Loan Agreement Forms?

There are various types of Loan Agreement Forms, including personal loans, business loans, mortgage loans, and student loans. Each type of loan agreement has its own specific terms and conditions tailored to the purpose of the loan.

How can I draft a clear and effective Loan Agreement Form?

To draft a clear and effective Loan Agreement Form, it is important to include all the essential elements, use clear and concise language, and seek legal advice if needed. You can also refer to sample loan agreement forms for guidance.