Loan Agreement Forms: A Comprehensive Guide to Understanding and Using Them

Loan agreements are essential financial documents that Artikel the terms and conditions of a loan between a lender and a borrower. They serve as legally binding contracts that protect the interests of both parties involved. Understanding the purpose, key elements, and legal implications of loan agreement forms is crucial for ensuring a smooth and secure borrowing process.

This comprehensive guide will delve into the intricacies of loan agreement forms, providing you with the knowledge and tools necessary to navigate the loan process confidently. We will explore the different types of loan agreement forms, identify the essential elements they contain, and discuss the legal implications of signing such forms. We will also provide tips on negotiating loan agreement terms, utilizing technology to streamline the process, and following best practices for effective use and storage of these important documents.

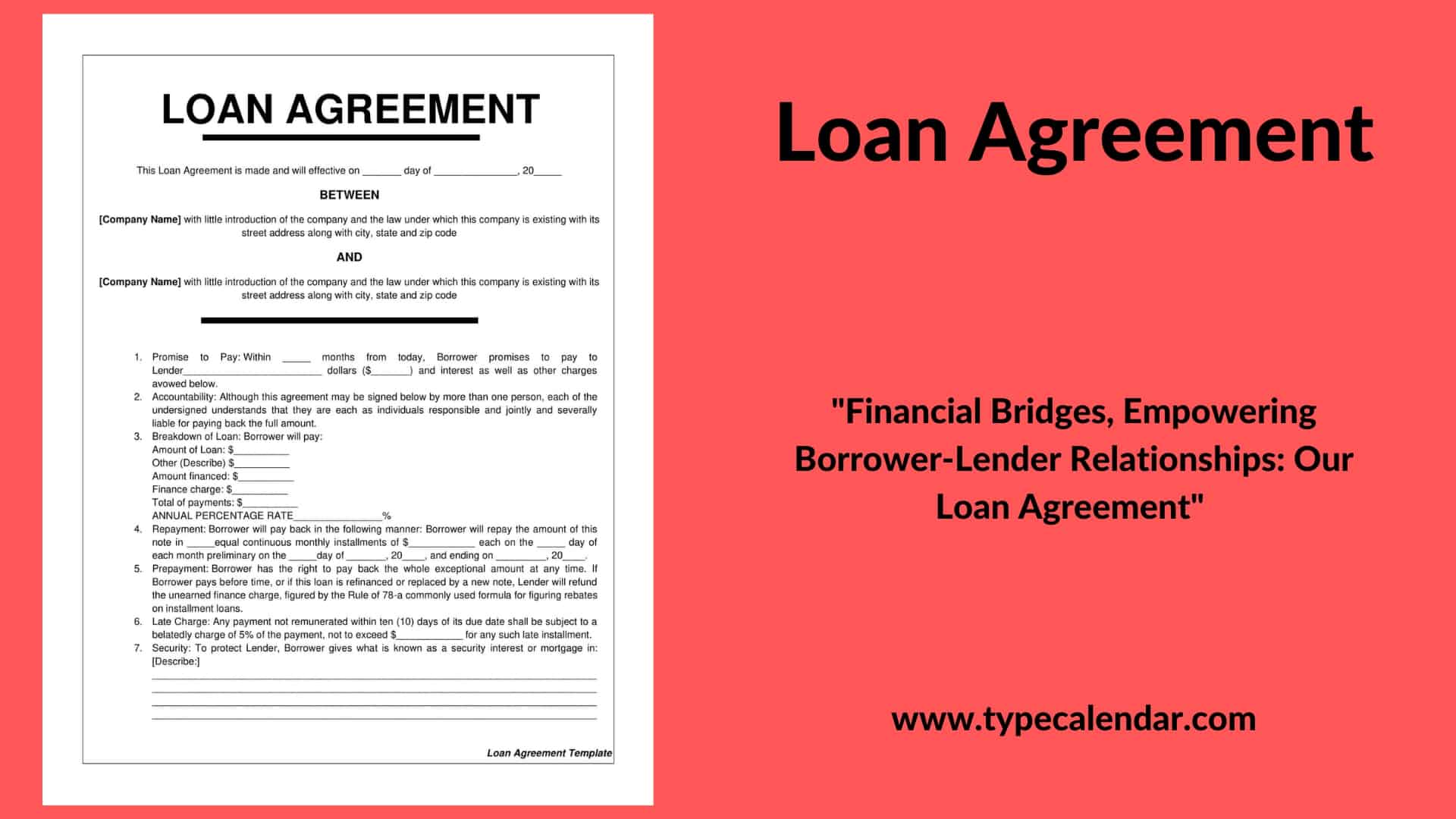

Loan Agreement Forms

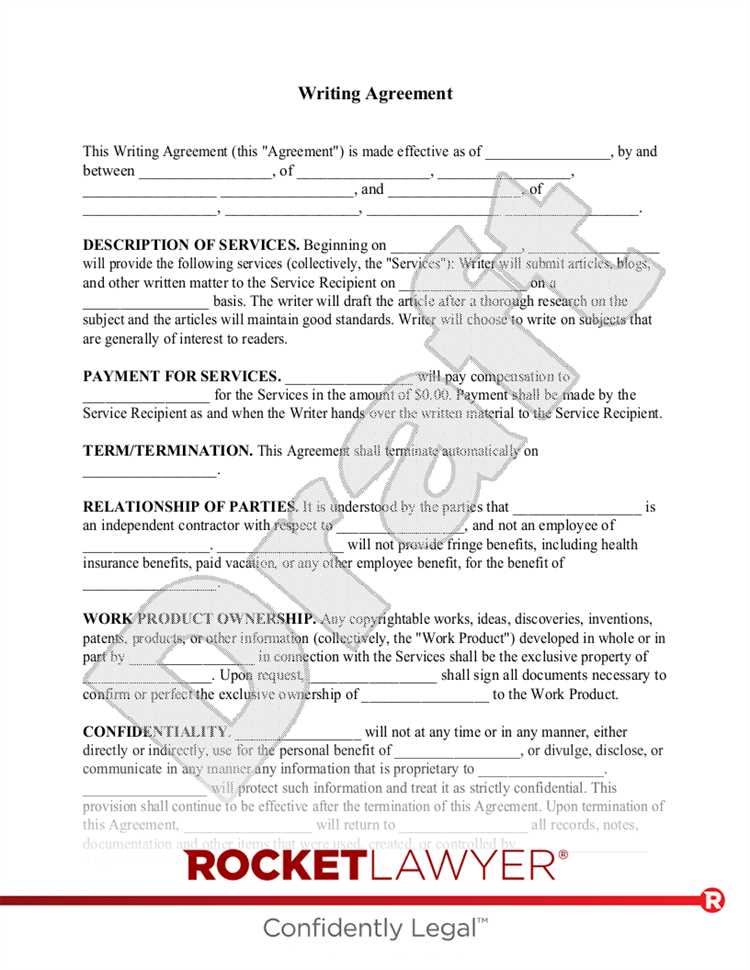

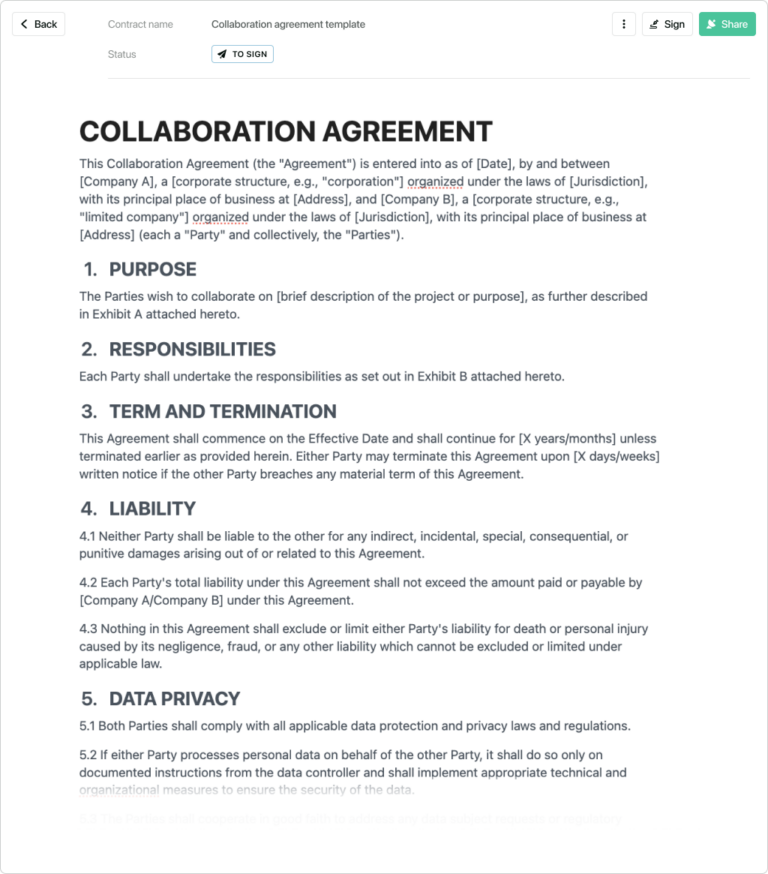

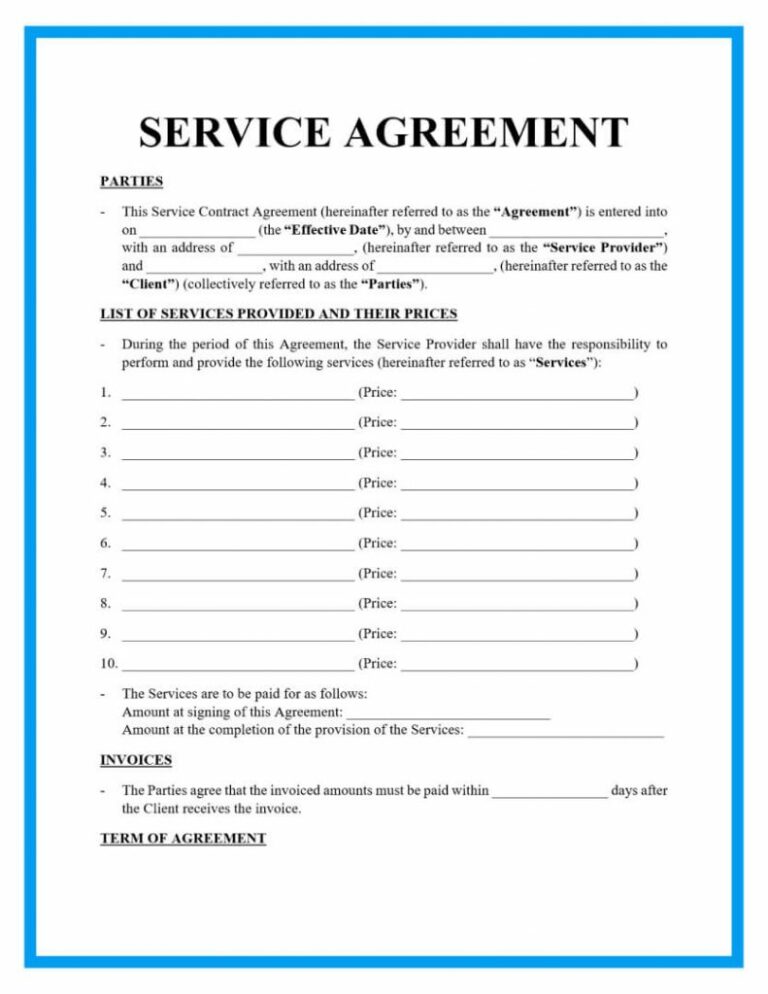

A loan agreement form is a legally binding contract between a lender and a borrower that Artikels the terms and conditions of a loan. It specifies the amount of money borrowed, the interest rate, the repayment schedule, and any other relevant details.

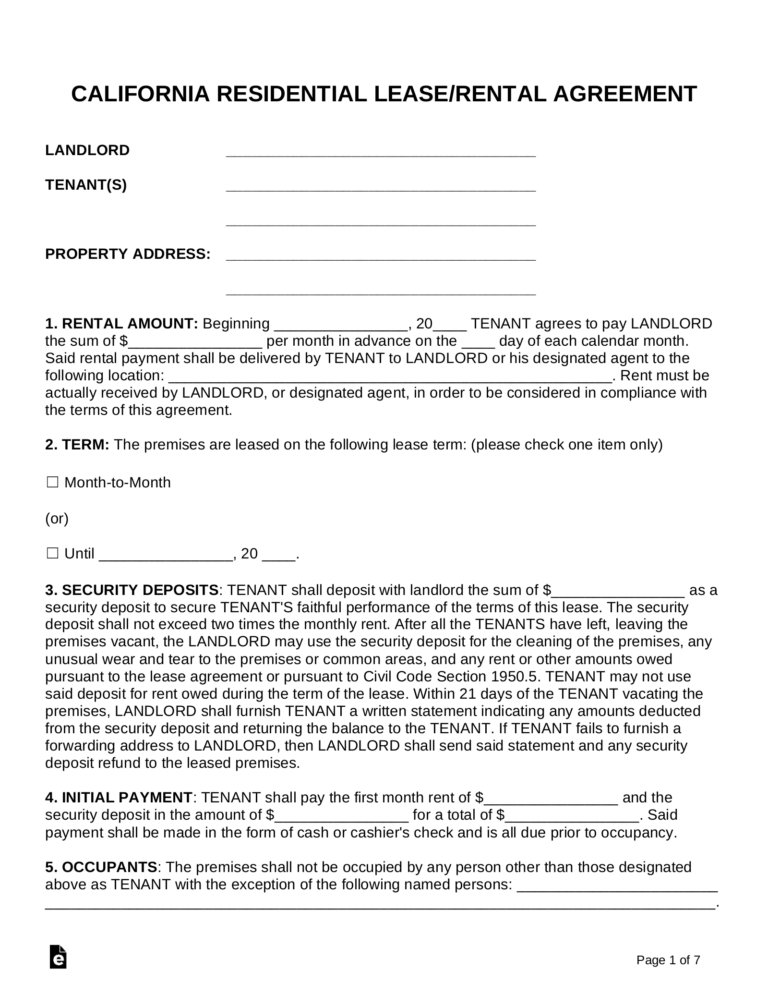

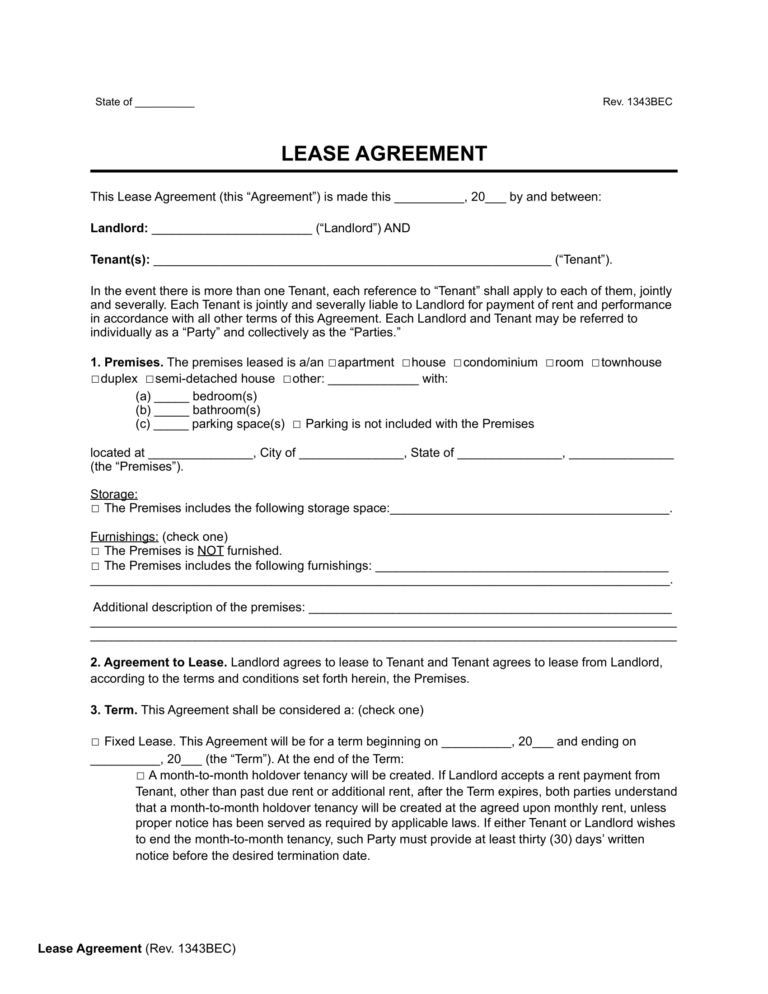

There are different types of loan agreement forms, each tailored to a specific type of loan. Some common types include:

Personal Loans

- Used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses.

- Typically have shorter repayment terms and higher interest rates than other types of loans.

Mortgages

- Used to finance the purchase of a home.

- Typically have longer repayment terms and lower interest rates than personal loans.

- Secured by the property being purchased.

Business Loans

- Used to finance business expenses, such as equipment purchases, inventory, or working capital.

- Can be secured or unsecured, and the terms and conditions vary depending on the lender and the borrower’s creditworthiness.

Using a loan agreement form is important because it ensures that both the lender and the borrower are clear on the terms of the loan. It helps to avoid misunderstandings and disputes, and it can protect both parties in the event of a default.

Key Elements of a Loan Agreement Form

A loan agreement form is a crucial document that Artikels the terms and conditions of a loan between a lender and a borrower. Understanding the key elements of this form is essential for both parties to ensure a clear and legally binding agreement.

The following are the essential elements of a loan agreement form:

Parties Involved

- Borrower: The individual or entity receiving the loan.

- Lender: The individual or entity providing the loan.

Loan Amount and Terms

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the loan amount over a specific period.

- Loan Term: The duration of the loan, typically expressed in months or years.

- Repayment Schedule: The frequency and amount of loan repayments.

Collateral

- Definition: Assets pledged by the borrower as security for the loan.

- Types: Collateral can include property, vehicles, or other valuable assets.

Covenants and Representations

- Covenants: Promises made by the borrower to the lender, such as maintaining insurance or using the loan for specific purposes.

- Representations: Statements made by the borrower about their financial situation or the purpose of the loan.

Default and Remedies

- Default: A breach of the loan agreement by the borrower.

- Remedies: Actions that the lender can take in case of default, such as repossession of collateral or legal action.

Signatures

The loan agreement form must be signed by both the borrower and the lender to indicate their acceptance of the terms and conditions.

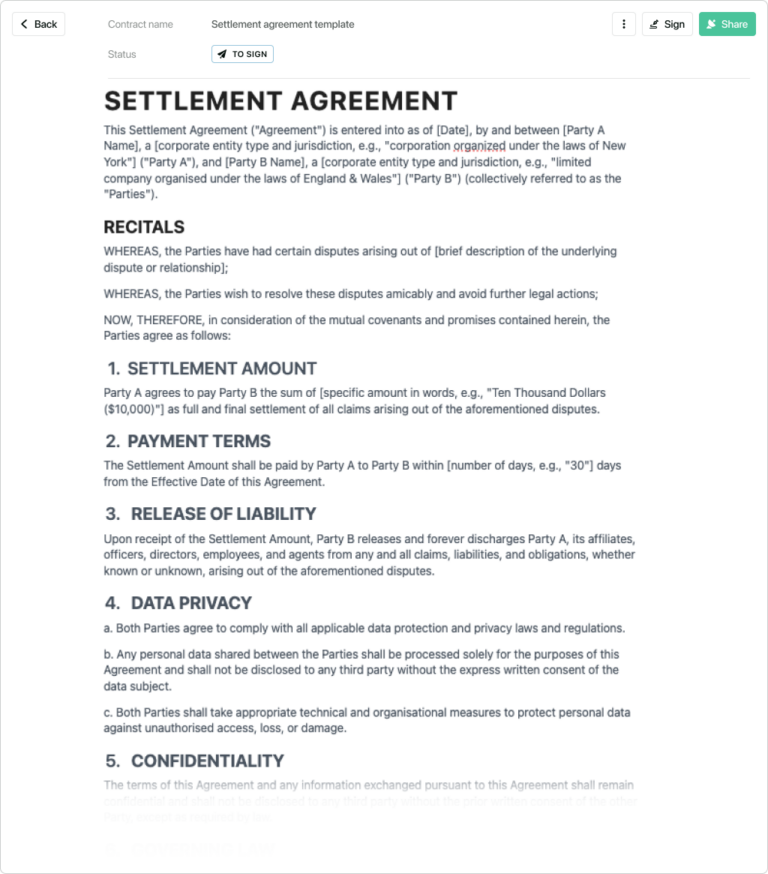

Legal Implications of a Loan Agreement Form

Signing a loan agreement form creates a legally binding contract between the borrower and the lender. This means that both parties are legally obligated to fulfill their respective obligations under the agreement. Failure to do so can result in serious legal consequences.

One of the most important legal implications of a loan agreement form is that it creates a debt obligation for the borrower. This means that the borrower is legally obligated to repay the loan amount, plus any interest and fees, in accordance with the terms of the agreement. If the borrower fails to make timely payments, the lender may take legal action to recover the debt, which could include garnishing wages, seizing assets, or even filing a lawsuit.

Another legal implication of a loan agreement form is that it may give the lender security interest in the borrower’s assets. This means that the lender may have the right to seize and sell the borrower’s assets if the borrower defaults on the loan. The type of security interest that the lender has will depend on the terms of the loan agreement.

It is important to read and understand the terms of a loan agreement form carefully before signing it. This will help you to avoid any potential legal issues down the road. If you have any questions about the agreement, you should consult with an attorney before signing it.

Consequences of Breaching a Loan Agreement Form

Breaching a loan agreement form can have serious legal consequences. The lender may take legal action to recover the debt, which could include garnishing wages, seizing assets, or even filing a lawsuit. The lender may also charge late fees and penalties, which can increase the cost of the loan. In some cases, the lender may even accelerate the loan, which means that the entire balance of the loan becomes due immediately.

If you are unable to make timely payments on your loan, it is important to contact the lender immediately. The lender may be willing to work with you to modify the terms of the loan or to create a repayment plan that you can afford. However, if you fail to communicate with the lender, the lender is more likely to take legal action.

Advice on How to Protect Yourself from Potential Legal Issues

There are a few things you can do to protect yourself from potential legal issues when signing a loan agreement form:

- Read and understand the terms of the agreement carefully before signing it.

- If you have any questions about the agreement, consult with an attorney before signing it.

- Make sure you can afford the loan payments before signing the agreement.

- Keep a copy of the loan agreement form for your records.

- If you are unable to make timely payments on your loan, contact the lender immediately.

By following these tips, you can help to avoid any potential legal issues when signing a loan agreement form.

Negotiating a Loan Agreement Form

Navigating the complexities of a loan agreement form can be a daunting task. However, by understanding the process and seeking professional advice, you can ensure that the terms of the loan align with your needs.

Before signing on the dotted line, take the time to thoroughly review the loan agreement form and understand the implications of each clause. Here are some tips to help you negotiate the terms of a loan agreement form:

Tips for Negotiating Loan Agreement Terms

- Read and understand the entire agreement: Before signing, make sure you have a clear understanding of every clause and its implications.

- Identify key terms: Focus on negotiating the terms that are most important to you, such as the interest rate, repayment period, and any fees or penalties.

- Research industry benchmarks: Compare the terms offered in the loan agreement form with industry standards to ensure you’re getting a fair deal.

- Be prepared to compromise: Negotiation is a give-and-take process. Be willing to compromise on some terms to secure the best possible deal overall.

Importance of Professional Advice

Negotiating a loan agreement form can be complex and time-consuming. Seeking professional advice from a lawyer or financial advisor can help you protect your interests and ensure that the agreement is fair and legally binding.

Common Negotiation Points

Some common negotiation points in loan agreement forms include:

- Interest rate: The interest rate charged on the loan.

- Repayment period: The length of time you have to repay the loan.

- Fees and penalties: Any additional fees or penalties that may apply, such as late payment fees or prepayment penalties.

- Collateral: Any assets that may be used as security for the loan.

- Covenants: Any restrictions or obligations that you must comply with during the term of the loan.

Technology and Loan Agreement Forms

Bruv, tech’s playing a sick role in making loan agreements a doddle. It’s like, streamlining the whole shebang.

First off, electronic loan agreement forms are the bomb. They’re way easier to fill out and sign than those ancient paper versions. Plus, you can do it all online, so you don’t even have to leave the crib.

Security of Electronic Loan Agreement Forms

Now, about security, don’t trip. Electronic loan agreement forms are just as safe as the paper ones, if not safer. They use encryption and other fancy stuff to keep your info under lock and key.

Best Practices for Using Loan Agreement Forms

Loan agreement forms are essential for protecting the interests of both borrowers and lenders. By following best practices, you can ensure that these forms are used effectively and avoid common pitfalls.

Understanding the Terms and Conditions

Before signing a loan agreement form, it’s crucial to thoroughly read and understand all the terms and conditions. Pay particular attention to the following key elements:

- Loan amount and repayment schedule

- Interest rate and fees

- Collateral requirements

- Default provisions

Avoiding Common Pitfalls

There are several common pitfalls to avoid when using loan agreement forms. These include:

- Not reading the form carefully before signing

- Signing a form that contains errors or omissions

- Failing to understand the implications of the terms and conditions

- Not keeping a copy of the signed form for your records

Storing and Managing Loan Agreement Forms

Once you have signed a loan agreement form, it’s important to store and manage it securely. Consider the following tips:

- Keep the original signed form in a safe place

- Make a copy of the form for your records

- Store the form electronically in a secure location

- Review the form periodically to ensure that you are still in compliance with the terms and conditions

FAQ

What is the purpose of a loan agreement form?

A loan agreement form serves as a legally binding contract that Artikels the terms and conditions of a loan between a lender and a borrower. It specifies the loan amount, interest rate, repayment schedule, and other relevant details, ensuring clarity and protection for both parties.

What are the different types of loan agreement forms?

There are various types of loan agreement forms tailored to specific loan purposes, such as personal loans, business loans, mortgages, and student loans. Each type includes unique provisions and clauses relevant to the particular loan scenario.

Why is it important to use a loan agreement form?

Using a loan agreement form is essential for several reasons. It provides a clear understanding of the loan terms, prevents misunderstandings or disputes, and serves as a legal record of the agreement. It also protects the rights and interests of both the lender and the borrower.

What are the key elements of a loan agreement form?

Key elements of a loan agreement form typically include the loan amount, interest rate, repayment schedule, loan term, default provisions, and security interests (if applicable). These elements define the essential details of the loan and ensure a comprehensive understanding of the agreement.

What are the legal implications of signing a loan agreement form?

Signing a loan agreement form creates a legally binding contract between the lender and the borrower. Both parties are obligated to fulfill the terms Artikeld in the agreement. Failure to comply with the agreement’s terms may result in legal consequences, such as late payment penalties, default, or even legal action.