The Importance of Understanding Agreement Form Payments

Navigating the complexities of financial agreements can be a daunting task, but understanding the intricacies of agreement form payments is paramount. These payments serve as the backbone of various transactions, ranging from business contracts to real estate purchases and employment agreements. By delving into the details of agreement form payments, we empower ourselves to make informed decisions and safeguard our financial interests.

This comprehensive guide will provide a thorough overview of agreement form payments, encompassing their purpose, components, processing methods, security considerations, and reconciliation processes. We will also address commonly asked questions to ensure a well-rounded understanding of this crucial aspect of financial management.

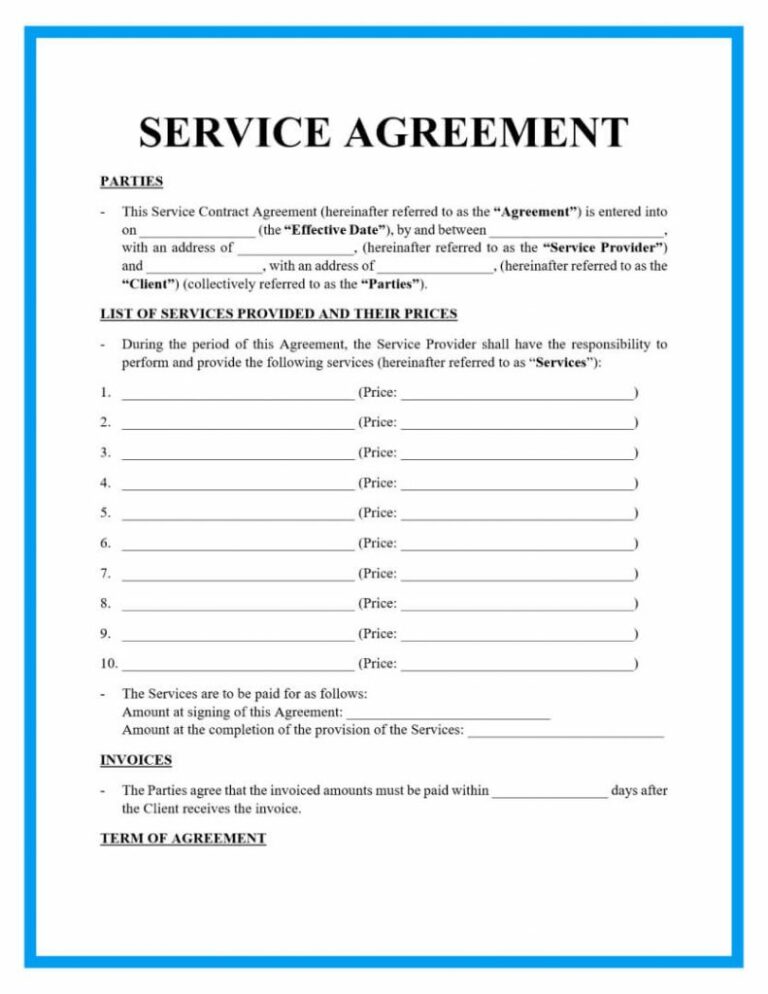

Payment Form Details

An agreement form payment is a document that Artikels the terms of payment for a specific agreement. It typically includes information such as the amount of the payment, the payment due date, the payment method, and any late payment fees.

Agreement form payments are used in a variety of situations, including business contracts, real estate transactions, and employment agreements. In a business contract, an agreement form payment may be used to secure a down payment or to establish a payment schedule for goods or services. In a real estate transaction, an agreement form payment may be used to secure a mortgage or to establish a payment schedule for the purchase of a property. In an employment agreement, an agreement form payment may be used to establish a salary or wage payment schedule.

The specific components of an agreement form payment will vary depending on the type of agreement. However, some common components include:

– The amount of the payment

– The payment due date

– The payment method

– Any late payment fees

It is important to carefully review an agreement form payment before signing it. This will help you to understand the terms of the payment and to avoid any misunderstandings or disputes later on.

Payment Processing Methods

Blokes and birds, when it comes to stumping up the dough for your agreement forms, you’ve got a few options. Let’s break it down, shall we?

Each way of paying your dues has its own perks and pitfalls, so let’s get the lowdown on each one.

Online Payments

If you’re a bit of a tech whizz, online payments are your go-to. These bad boys let you sort out your agreement form payments from the comfort of your sofa, no need to even put on your glad rags.

Online payments are generally pretty speedy and secure, so you can rest easy knowing your hard-earned cash is safe and sound. Plus, you’ll have a digital record of your payment for your records.

However, online payments might not be the best option if you’re not comfortable with using the internet or if you don’t have a reliable internet connection.

Bank Transfers

If you’re more of a traditionalist, bank transfers are a solid choice. You can pop into your local bank or do it online if you’re feeling fancy.

Bank transfers are generally safe and secure, and they’re usually pretty quick too. Plus, you can track your payment online, so you can keep an eye on it every step of the way.

The downside of bank transfers is that they can sometimes incur fees, especially if you’re transferring money between different banks.

Cash Payments

Now, if you’re a bit of a cash connoisseur, you might prefer to pay your agreement form payments in cold, hard cash. This method is as old as the hills, but it still gets the job done.

Cash payments are super convenient, and you don’t have to worry about any fees or security concerns. However, carrying around large amounts of cash can be a bit risky, so it’s best to only use this method for smaller payments.

Payment Security Considerations

When processing agreement form payments, it’s vital to be aware of potential security risks like fraud, data breaches, and unauthorized access. To safeguard against these threats, implementing robust security measures is crucial.

Encryption, authentication, and fraud detection systems are essential security tools. Encryption scrambles sensitive data during transmission, making it unreadable to unauthorized parties. Authentication verifies the identity of users, ensuring only authorized individuals can access payment information. Fraud detection systems monitor transactions for suspicious patterns, flagging potentially fraudulent activities.

Best Practices for Maintaining Payment Security

- Use secure payment gateways that comply with industry standards like PCI DSS.

- Store sensitive data securely, using encryption and access controls.

- Implement fraud detection systems to monitor transactions for suspicious patterns.

- Regularly review and update security measures to stay ahead of evolving threats.

- Educate employees on payment security best practices and phishing scams.

Payment Reconciliation and Reporting

Squashing payment errors and making sure everything’s on the level is key. It’s like keeping your accounts in tip-top shape, bruv.

There’s two ways to sort this out: doing it by hand or letting the machines do the work. Either way, it’s about checking that the dough coming in matches what’s on the agreement forms. It’s like a game of “spot the difference,” but with money.

Reporting Requirements

Once you’ve got your payments sorted, it’s time to dish out the deets. Customers need to know where their bread went, and the taxman wants his cut. So, you’ll need to send out statements and file those tax returns like a boss.

Questions and Answers

What are the common payment methods used in agreement form payments?

Agreement form payments can be processed through various methods, including online payments, bank transfers, and cash payments. Each method offers its own advantages and disadvantages, and the choice of payment method should be based on the specific circumstances of the agreement.

How can I ensure the security of my agreement form payments?

Protecting the security of agreement form payments is crucial to prevent fraud and unauthorized access. Implementing robust security measures such as encryption, authentication, and fraud detection systems is essential. Additionally, maintaining best practices for payment security, such as using secure payment gateways and regularly monitoring transactions, is highly recommended.

What is the importance of reconciling agreement form payments?

Reconciling agreement form payments is essential to ensure accuracy and completeness. It involves matching payments received with the corresponding invoices or agreements to identify any discrepancies or errors. Regular reconciliation helps maintain financial integrity, prevents oversights, and facilitates timely follow-up actions.