Buy Sell Agreement Templates: A Comprehensive Guide for Business Owners

In the dynamic landscape of business, it’s imperative to have a solid foundation to navigate the complexities of ownership and exit strategies. Buy-sell agreement templates provide a framework for creating legally binding agreements that protect the interests of all parties involved. By understanding the key features, types, customization options, and legal considerations of these templates, business owners can effectively safeguard their investments and ensure a smooth transition of ownership.

Whether you’re a seasoned entrepreneur or a startup founder, this guide will equip you with the knowledge to harness the power of buy-sell agreement templates. Dive in and discover how these tools can streamline your agreement creation process, minimize risks, and empower you to make informed decisions about the future of your business.

Key Features and Benefits of Buy-Sell Agreement Templates

Blud, listen up. Buy-sell agreement templates are the bomb when it comes to keeping your business dealings squeaky clean. They’re like a cheat code that makes drafting legally binding agreements a breeze.

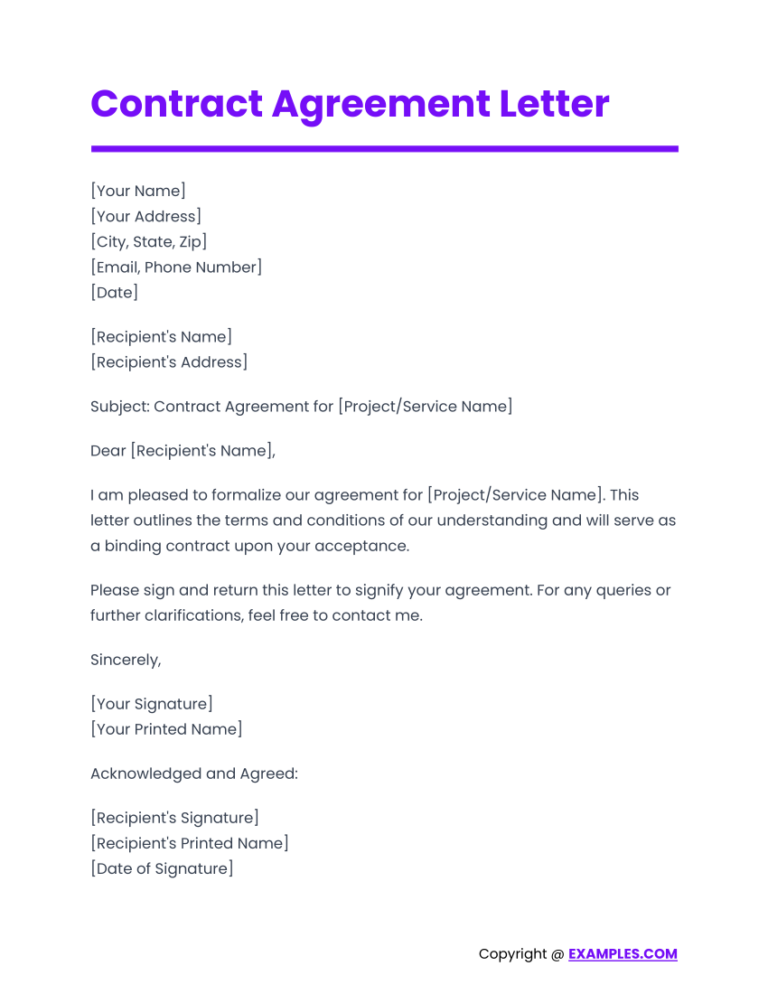

These templates got all the essential bits covered, like the names of the parties involved, the terms of the sale, and any special conditions you might need. Plus, they’re customizable, so you can tailor them to fit your specific situation.

Streamlining the Process

Using a template is like having a cheat code for creating agreements. You don’t have to start from scratch, which saves you a ton of time and effort. Just fill in the blanks with your own info, and boom, you’re done.

Reducing Errors

Templates help you avoid costly mistakes. They’ve been drafted by legal experts who know their stuff, so you can rest assured that the agreement you’re creating is legally sound.

Types of Buy-Sell Agreement Templates

Bruv, let’s get real about the different types of buy-sell agreement templates out there. Each one’s got its own swag, so it’s vital to pick the right one for your biz.

Partnerships

If you’re rollin’ with a partnership, you’ll need a buy-sell agreement template that covers all the bases, innit? It should sort out what happens when a partner wants to bounce, kicks the bucket, or goes bankrupt. Plus, it should have rules for transferring ownership and valuing the biz.

LLCs

For your LLC, you’ll need a template that’s tailored to its structure. It should include provisions for managing member exits, involuntary removals, and the distribution of profits and losses. That way, everyone’s on the same page and there’s no beef when it comes to splitting the loot.

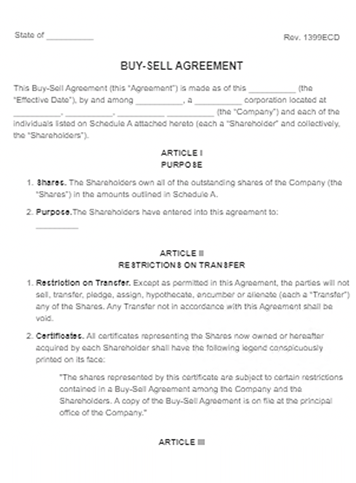

Corporations

Corporations have their own unique setup, so you’ll need a buy-sell agreement template that takes that into account. It should cover stock transfers, shareholder rights, and the process for merging or dissolving the company. With this template in place, you’ll be able to navigate the ups and downs of corporate life like a pro.

Customization Options for Buy-Sell Agreement Templates

Buy-sell agreement templates are not set in stone, bruv. They’re like blank canvases that you can paint to match the unique needs of your business. Whether you’re a one-man band or a multinational corporation, there’s a template out there that can be tweaked to fit you like a glove.

Here’s the lowdown on how you can customize these templates to make them your own:

Unique Ownership Structures

Not all businesses are created equal, and neither are their ownership structures. If you’ve got a complex setup with multiple owners, different classes of shares, or special voting rights, the template can be tailored to reflect that. It’s like a tailor-made suit for your business!

Valuation Methods

Figuring out how much your business is worth is no walk in the park. There are different valuation methods out there, each with its own pros and cons. The template can be customized to specify which method you’ll use, so there’s no room for confusion down the line.

Exit Strategies

Life’s full of surprises, and sometimes you might want to jump ship from your business. The template can be customized to Artikel different exit strategies, such as selling your shares to another owner, bringing in a new investor, or even shutting down the business altogether. It’s like having a roadmap for your business’s future.

Common Customization Options

- Triggering events: What events will trigger the buy-sell agreement, such as death, disability, or retirement?

- Purchase price: How will the purchase price of the shares be determined?

- Payment terms: How and when will the purchase price be paid?

- Dispute resolution: What happens if there’s a disagreement about the interpretation or enforcement of the agreement?

Customizing a buy-sell agreement template is like putting together a puzzle. It takes a bit of time and effort, but the end result is a document that’s tailored to your specific needs. So don’t be afraid to mix and match different options until you find the perfect fit for your business.

Legal Considerations When Using Buy-Sell Agreement Templates

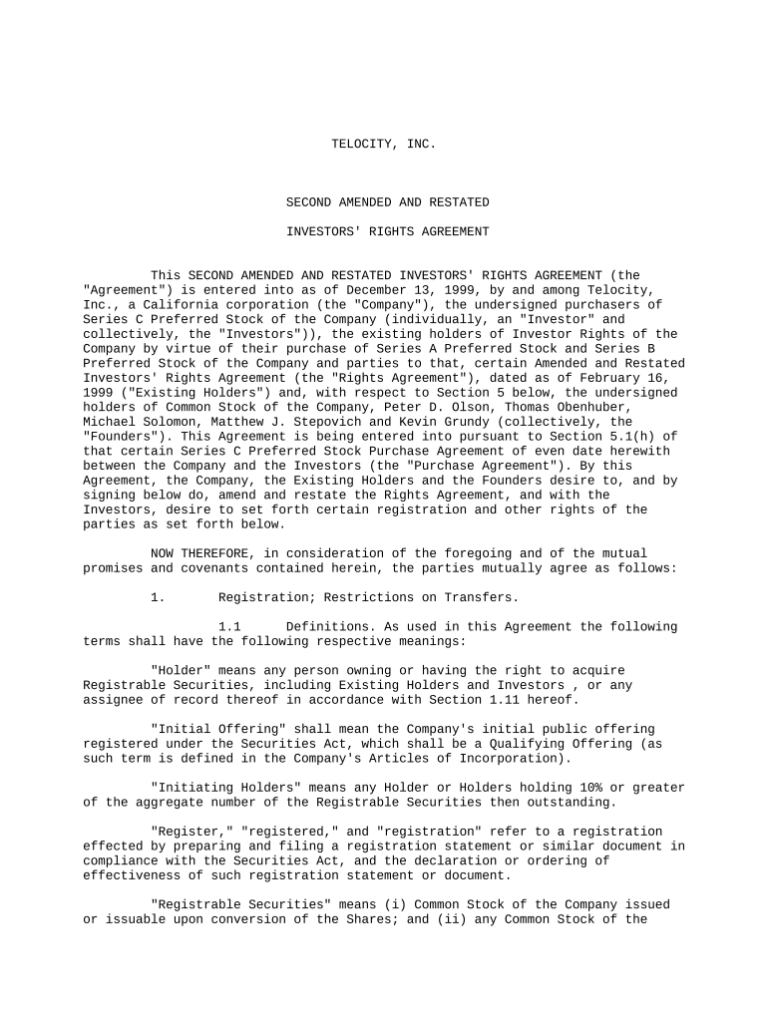

Before using a buy-sell agreement template, seeking legal advice is crucial. It ensures the template aligns with your specific needs and complies with applicable laws.

An attorney can review the template, identify potential legal pitfalls, and customize it to meet your requirements. They can also explain complex legal concepts and ensure the agreement is enforceable and protects your interests.

Importance of Legal Advice

Legal advice is essential to avoid potential legal issues arising from using a template. An attorney can help you:

- Identify potential legal pitfalls and liabilities associated with the template.

- Ensure the template complies with applicable laws and regulations.

- Customize the template to fit your specific business needs and circumstances.

- Explain complex legal concepts and clauses in a clear and understandable manner.

Role of an Attorney

An attorney can play a crucial role in reviewing and customizing buy-sell agreement templates:

- Review the template: An attorney can review the template to identify any potential legal issues or loopholes that may affect your interests.

- Identify legal pitfalls: An attorney can identify potential legal pitfalls associated with the template and advise you on how to avoid them.

- Customize the template: An attorney can customize the template to meet your specific business needs and circumstances, ensuring it aligns with your intentions and goals.

- Explain legal concepts: An attorney can explain complex legal concepts and clauses in a clear and understandable manner, ensuring you fully comprehend the agreement’s terms.

Best Practices for Implementing Buy-Sell Agreement Templates

Implementing buy-sell agreement templates effectively involves following a structured process and ensuring all relevant parties are involved and informed. By utilizing these templates, businesses can streamline the process of creating legally binding agreements that govern the transfer of ownership interests.

Step-by-Step Guide

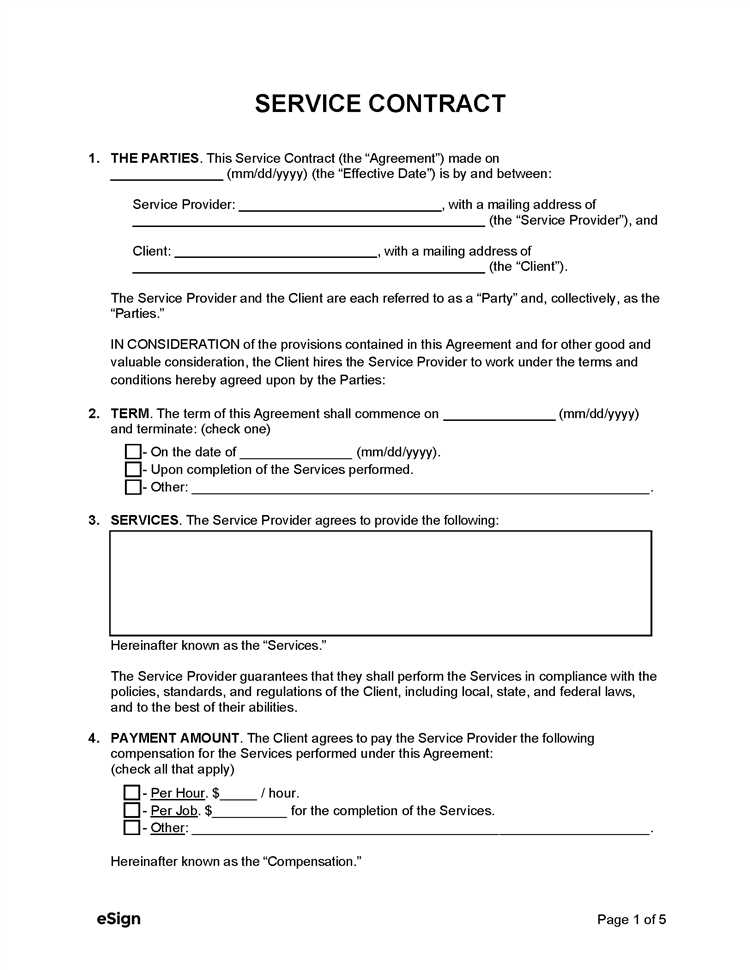

- Identify Relevant Parties: Determine the individuals or entities involved in the buy-sell agreement, including the business owners, shareholders, and any potential buyers or sellers.

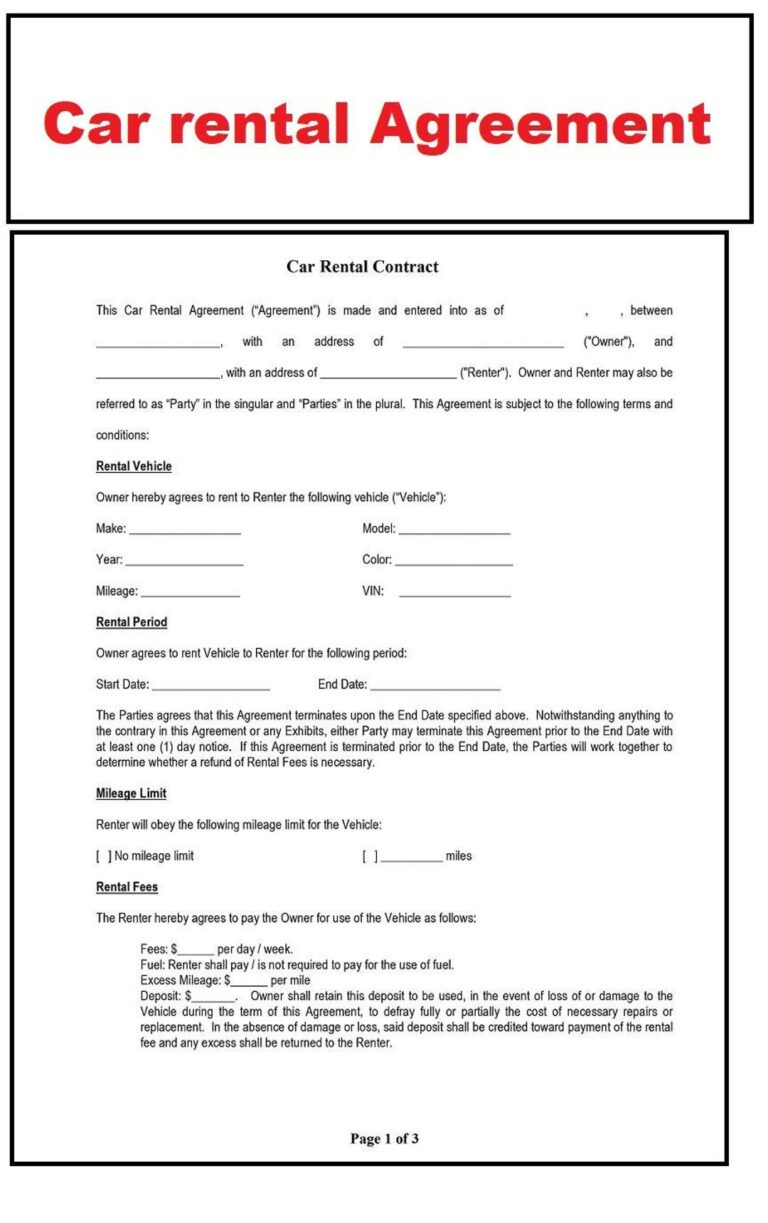

- Select a Suitable Template: Choose a buy-sell agreement template that aligns with the specific needs and circumstances of the business, considering factors such as the type of business entity and the desired terms of the agreement.

- Involve Legal Counsel: Consult with a qualified attorney to review the template and provide legal advice on its implications and ensure compliance with applicable laws.

- Negotiate and Customize: Negotiate the terms of the agreement with all relevant parties, using the template as a starting point. Customize the template to reflect the specific arrangements and understandings between the parties.

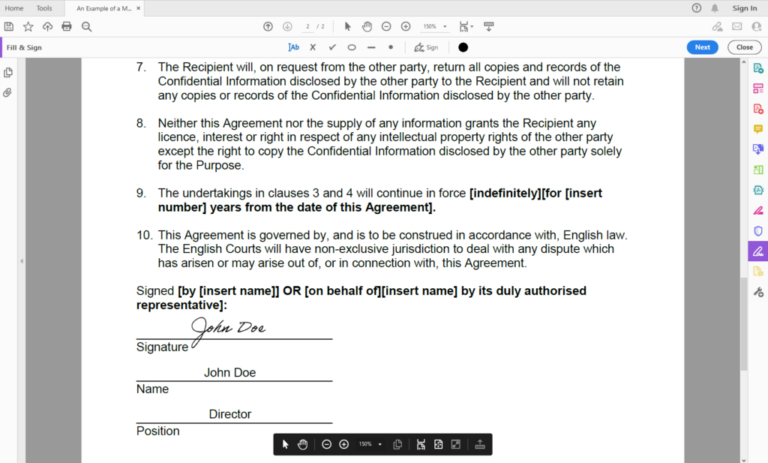

- Execute the Agreement: Once the terms are finalized, execute the buy-sell agreement by having all parties sign and date the document. Ensure that the execution complies with legal requirements for validity.

Importance of Involving All Parties

Involving all relevant parties in the implementation process is crucial to ensure that everyone’s interests are represented and that the agreement is mutually acceptable. This includes obtaining input from business owners, shareholders, and any potential buyers or sellers. By involving all parties, businesses can increase the likelihood of reaching a fair and equitable agreement that meets the needs of everyone involved.

Tips for Negotiating and Executing Buy-Sell Agreements

Negotiating and executing buy-sell agreements using templates requires careful consideration and attention to detail. Here are some tips to help ensure a successful outcome:

- Communicate Clearly: Ensure that all parties involved have a clear understanding of the terms of the agreement and their respective rights and obligations.

- Consider Tax Implications: Be aware of the potential tax consequences of the buy-sell agreement and seek professional advice if necessary.

- Review Regularly: Regularly review the buy-sell agreement to ensure that it remains aligned with the evolving needs of the business and its owners.

Common Mistakes to Avoid When Using Buy-Sell Agreement Templates

Failing to Customize the Template

Not taking the time to customize the template to your specific business needs can lead to misunderstandings and disputes. Ensure the template reflects your company’s unique ownership structure, valuation methods, and exit strategies.

Not Seeking Legal Advice

Relying solely on a template without seeking legal advice can be a costly mistake. A lawyer can help you understand the legal implications of the agreement and ensure it aligns with your business goals and applicable laws.

Not Considering Tax Implications

Overlooking the tax implications of a buy-sell agreement can result in unexpected tax liabilities. Consult with a tax advisor to determine the potential tax consequences of different agreement provisions.

Ignoring Funding Mechanisms

Failing to address how the purchase price will be funded can create financial challenges. Clearly Artikel the funding sources and mechanisms to avoid disputes or delays in executing the agreement.

Not Addressing Dispute Resolution

Neglecting to include a dispute resolution mechanism can make it difficult to resolve disagreements amicably. Specify a clear process for addressing disputes, such as mediation or arbitration.

Questions and Answers

What are the key elements of a buy-sell agreement template?

Essential elements include identification of parties, definition of ownership interests, trigger events for sale, purchase price determination, payment terms, and dispute resolution mechanisms.

How can templates streamline the agreement creation process?

Templates provide a pre-defined structure and language, reducing the time and effort required to draft a legally binding agreement.

What types of buy-sell agreement templates are available?

Templates are available for various business entities, such as partnerships, LLCs, and corporations, each with specific provisions tailored to the entity’s structure.

Can templates be customized to meet specific business needs?

Yes, templates offer flexibility and can be customized to address unique ownership structures, valuation methods, and exit strategies.

Why is it important to seek legal advice when using buy-sell agreement templates?

Legal counsel can review and customize templates to ensure compliance with applicable laws and align with the specific needs of your business.