Excel Expense Report Templates: Streamline Your Expense Management

In today’s fast-paced business world, managing expenses effectively is crucial for organizations to maintain financial control and optimize operations. Excel expense report templates provide a powerful solution to streamline expense tracking, automate calculations, and improve compliance.

These customizable templates offer a wide range of benefits, including simplified data entry, enhanced accuracy, and seamless integration with accounting systems. By leveraging the power of Excel, businesses can gain valuable insights into their spending patterns, identify areas for cost optimization, and make informed decisions.

Understanding Excel Expense Report Templates

Excel expense report templates are pre-formatted spreadsheets that provide a structured way to record and track business expenses. Using these templates can save you time and ensure that your expense reports are accurate and complete.

There are many different types of expense report templates available, each designed for a specific purpose. Some common types of expense report templates include:

- Basic expense report templates: These templates include the basic information needed to track expenses, such as the date, vendor, amount, and category.

- Mileage expense report templates: These templates include additional fields for tracking mileage, such as the starting and ending mileage, the purpose of the trip, and the total mileage claimed.

- Per diem expense report templates: These templates include fields for tracking per diem expenses, such as the number of days claimed, the per diem rate, and the total per diem amount.

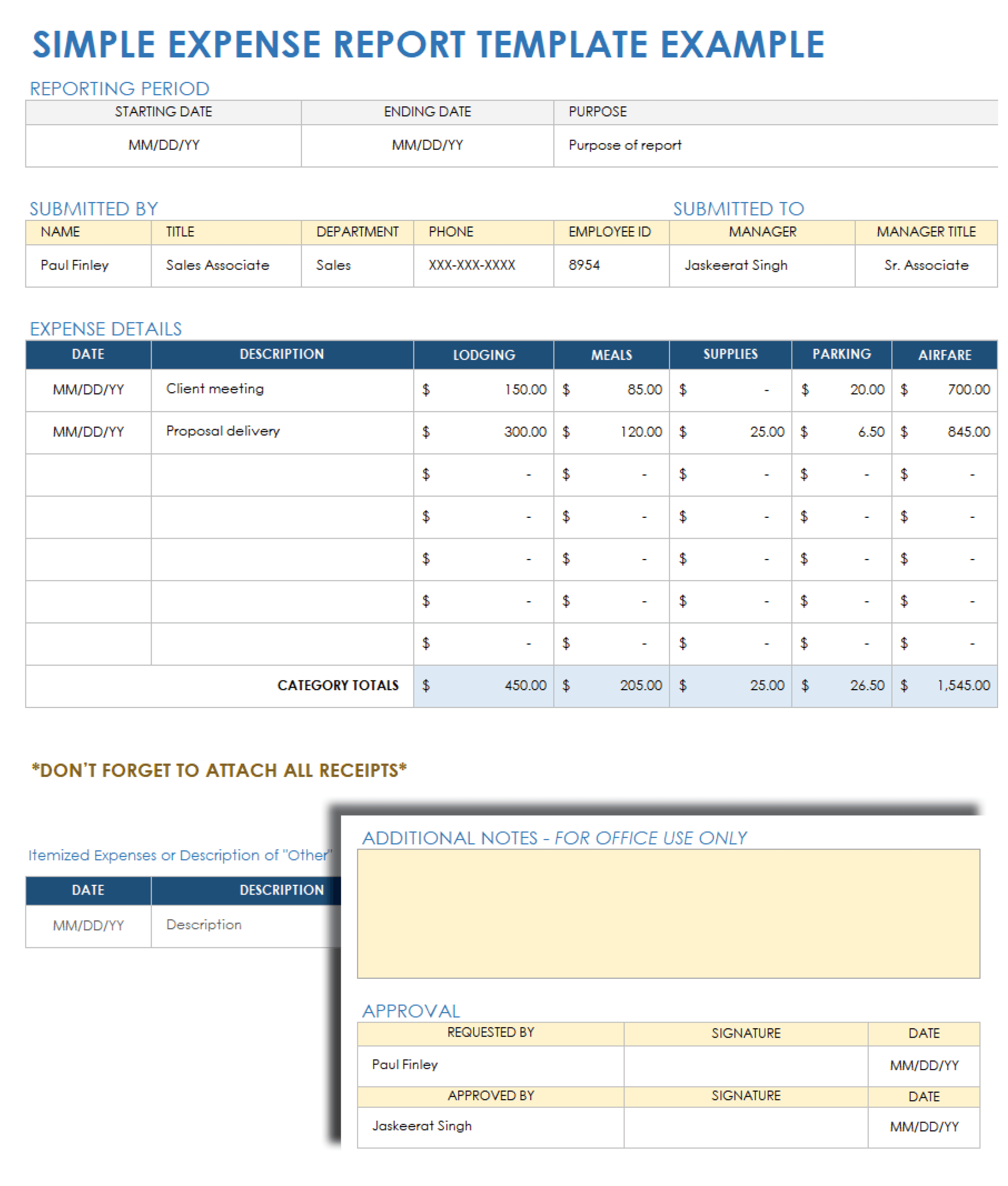

A well-designed expense report template should include the following key components:

- A clear and concise layout: The template should be easy to read and understand, with well-organized sections for different types of expenses.

- Required fields: The template should include all of the fields that are required by your company’s expense reimbursement policy.

- Validation rules: The template should include validation rules to ensure that the data entered into the template is accurate and complete.

- Approval workflow: The template should include a workflow for approving expense reports, which may involve multiple levels of approval.

Creating Custom Excel Expense Report Templates

Whip up your own bespoke Excel expense report templates to track your dosh like a pro. It’s a doddle, so let’s dive in.

First, fire up Excel and create a new workbook. Name it something snazzy like “Expense Tracker Extravaganza”.

Template Structure and Layout

- Set up a header with your company logo, address, and contact info.

- Create a table with columns for Date, Description, Amount, and Category.

- Add a summary section at the bottom to calculate total expenses by category.

Customizing Your Template

- Tailor the categories to suit your business needs. Think “Travel”, “Meals”, “Equipment”, and so on.

- Add formulas to automatically calculate totals and subtotals.

- Use conditional formatting to highlight certain expenses, like those over a certain amount.

- Protect cells that shouldn’t be tampered with, like the formulas.

Using Excel Formulas and Functions in Expense Report Templates

Excel formulas and functions are powerful tools that can automate calculations, improve efficiency, and make your expense report templates more dynamic and accurate.

Some of the most useful formulas and functions for expense report templates include:

SUM Function

The SUM function adds up a range of cells. This can be used to calculate the total amount of expenses, reimbursements, or other metrics.

For example, the following formula would calculate the total amount of expenses in the range A1:A10:

=SUM(A1:A10)

AVERAGE Function

The AVERAGE function calculates the average of a range of cells. This can be used to calculate the average expense per day, per week, or per month.

For example, the following formula would calculate the average expense per day in the range A1:A10:

=AVERAGE(A1:A10)

IF Function

The IF function performs a logical test and returns a different value depending on the result of the test.

For example, the following formula would return “Yes” if the expense in cell A1 is greater than $100, and “No” if it is less than or equal to $100:

=IF(A1>100,”Yes”,”No”)

These are just a few of the many formulas and functions that can be used in expense report templates. By using these tools, you can automate calculations, improve accuracy, and make your templates more efficient.

Formatting and Presenting Expense Report Templates

Proper formatting and presentation of expense report templates are crucial for professional and efficient expense management. Here are some guidelines:

Using Conditional Formatting

Conditional formatting allows you to apply specific formatting (e.g., colour, font) to cells based on predefined conditions. This helps visually highlight important information or exceptions, making the expense report easier to review.

Data Validation

Data validation ensures that users enter valid data into the expense report. This prevents errors and inconsistencies, improving the accuracy and reliability of the expense data.

Organizing and Presenting Data

Organize the expense report template logically, grouping related expenses together. Use clear headings, subheadings, and tables to present data concisely and avoid clutter.

Best Practices

* Use a consistent formatting style throughout the template.

* Ensure the template is easy to navigate and understand.

* Provide clear instructions and guidance for completing the report.

* Consider using electronic signatures to streamline the approval process.

Automating Expense Report Submission and Approval

Get ready to wave goodbye to the tedious task of manually submitting and approving expense reports. We’re diving into the realm of automation, where your reports will zip through the process like a supersonic jet. We’ll show you how to harness the power of macros, VBA code, and third-party tools to streamline your workflow, making expense reporting a breeze.

Think of it as a turbo boost for your expense management, saving you precious time and reducing the risk of errors. Plus, it’ll impress your boss with your tech-savvy skills.

Benefits of Automating Expense Report Processing

- Lightning-fast submission and approval process.

- Say goodbye to paperwork and manual data entry.

- Reduced errors and increased accuracy.

- Improved compliance with company policies.

- Freeing up your time for more important tasks.

Challenges of Automating Expense Report Processing

- Initial setup and configuration can be time-consuming.

- Requires technical expertise or reliance on external tools.

- Potential security concerns with third-party tools.

- May not be suitable for all organizations or expense reporting needs.

Methods for Automating Expense Report Submission and Approval

Now, let’s explore the magic behind automating your expense reporting process.

Macros and VBA Code

Macros and VBA (Visual Basic for Applications) are built-in tools in Microsoft Excel that allow you to create custom functions and automate repetitive tasks. With these tools, you can create buttons or keyboard shortcuts that trigger automated actions, such as submitting reports or generating summaries.

Third-Party Tools

If you’re not comfortable with macros or VBA, there are plenty of third-party tools available that offer automated expense reporting solutions. These tools typically integrate with your accounting software and provide a user-friendly interface for submitting, approving, and tracking expenses.

Integrating Excel Expense Report Templates with Accounting Systems

Integrating Excel expense report templates with accounting systems streamlines expense reporting and simplifies the reconciliation process. It eliminates the need for manual data entry, reduces errors, and provides a more efficient way to track and manage expenses.

Benefits of Integration

- Seamless data transfer: Automated data transfer between the expense report template and accounting system eliminates manual data entry and ensures accuracy.

- Simplified reconciliation: Automated reconciliation matches expenses in the report with corresponding transactions in the accounting system, reducing reconciliation time and effort.

- Improved efficiency: Integration automates repetitive tasks, freeing up time for more strategic activities.

Methods of Integration

There are several methods for integrating Excel expense report templates with accounting software:

- Direct integration: This method involves using a direct connection between the expense report template and the accounting system, allowing for real-time data transfer.

- Import/export: This method involves manually importing expense report data from Excel into the accounting system or exporting data from the accounting system into Excel.

- Third-party tools: These tools provide a bridge between Excel and accounting systems, automating data transfer and reconciliation.

Best Practices for Managing Expense Reports with Excel Templates

Effectively managing expense reports with Excel templates requires implementing best practices that ensure accuracy, compliance, and efficiency. These practices encompass setting clear policies, streamlining expense tracking, and utilizing Excel’s capabilities to automate processes.

Setting Clear Policies and Procedures

Establish clear guidelines for expense reporting, including eligible expenses, documentation requirements, and submission deadlines. Communicate these policies to employees and ensure they are easily accessible for reference.

Streamlining Expense Tracking

Encourage employees to track expenses promptly and accurately using the designated Excel template. Provide clear instructions on how to record expenses, including essential details such as date, vendor, amount, and purpose.

Reconciling Receipts

Emphasize the importance of attaching receipts to support expense claims. Set up a system for reconciling receipts with expense reports to ensure accuracy and prevent duplicate submissions.

Ensuring Compliance

Review expense reports thoroughly for compliance with company policies and regulations. Implement approval workflows to ensure appropriate authorization before reimbursement.

Utilizing Excel’s Capabilities

Take advantage of Excel’s formulas and functions to automate calculations, such as expense totals and tax deductions. Use conditional formatting to highlight potential errors or flag expenses that require additional review.

Automating Submission and Approval

Consider using Excel’s VBA macros or third-party add-ins to automate the expense report submission and approval process. This can save time and reduce manual errors.

Integrating with Accounting Systems

Explore the integration of Excel expense report templates with your accounting system. This can streamline the reimbursement process and provide a centralized view of expenses.

Examples and Case Studies of Excel Expense Report Templates

Excel expense report templates are a versatile tool used across various industries to streamline expense tracking and reporting. Let’s explore real-world examples and case studies to understand their practical applications and impact on business efficiency.

Case Study: Technology Firm

A technology firm implemented an Excel expense report template to automate expense tracking for its remote employees. The template integrated with the company’s accounting system, allowing employees to submit expenses directly from the template. This streamlined the approval process, reduced errors, and improved expense visibility for managers.

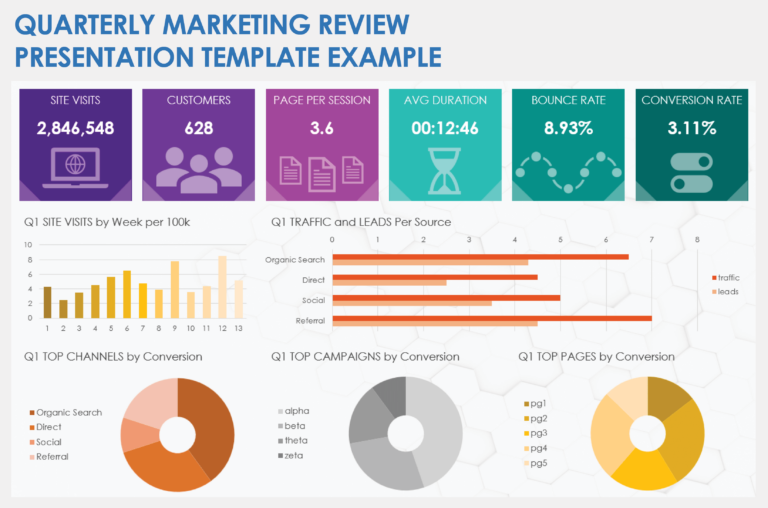

Innovative Use: Expense Analysis

A marketing agency used an Excel expense report template to not only track expenses but also analyze spending patterns. By leveraging pivot tables and formulas, the agency identified areas of overspending and opportunities for cost optimization. This data-driven approach helped them make informed decisions about expense management.

Success Story: Non-Profit Organization

A non-profit organization implemented an Excel expense report template to manage expenses for multiple projects and grants. The template included customizable fields to capture project-specific expenses. This enabled the organization to easily track expenses against budgets, generate reports for donors, and improve accountability.

Answers to Common Questions

Can I use Excel expense report templates for my specific industry?

Yes, Excel expense report templates are highly customizable and can be tailored to meet the specific requirements of different industries. Whether you’re in healthcare, manufacturing, or retail, you can create templates that align with your unique expense categories and business processes.

How do I ensure compliance with expense reporting regulations?

Excel expense report templates can be designed to include fields for capturing all necessary information required for compliance purposes. By incorporating validation rules and automated calculations, you can help ensure that expense reports are accurate, complete, and meet regulatory standards.

Can I automate the expense report approval process?

Yes, Excel expense report templates can be integrated with workflow automation tools or custom VBA code to streamline the approval process. This allows managers to review and approve expenses electronically, saving time and reducing the risk of manual errors.