Expense Report Templates: Streamline Expense Tracking and Simplify Compliance

Expense report templates are an essential tool for businesses and individuals alike. They provide a structured and organized way to track and report expenses, ensuring accuracy, transparency, and compliance. In today’s digital age, numerous types of expense report templates are available, each offering unique advantages and catering to specific requirements.

Utilizing expense report templates not only simplifies expense tracking but also streamlines the reimbursement process, enhances accountability, and minimizes the risk of errors or fraud. By providing a standardized format, templates ensure consistency, reduce processing time, and improve the efficiency of expense management.

Overview of Expense Report Templates

Expense report templates are pre-designed forms that provide a structured and organized way to record and submit expense claims. They typically include fields for capturing essential information such as the date, vendor, expense category, amount, and purpose of the expense.

Using expense report templates offers several benefits. They streamline the expense reporting process by providing a consistent format, reducing errors and inconsistencies. Templates also ensure that all necessary information is captured, facilitating efficient processing and approval. Additionally, templates can help organizations comply with internal policies and external regulations related to expense reporting.

Types of Expense Report Templates

Expense report templates come in a variety of formats, each with its own advantages and disadvantages. Here’s a rundown of some of the most common types:

Pre-designed Templates

These templates are ready-to-use and typically provided by accounting software or online platforms. They often include basic fields for recording expenses, such as date, description, amount, and receipt number. Pre-designed templates are convenient and easy to use, but they may not be customizable to meet specific business needs.

Customizable Templates

Customizable templates allow you to tailor the template to your specific requirements. You can add or remove fields, change the layout, and even include your company’s branding. Customizable templates offer greater flexibility but require more time and effort to create.

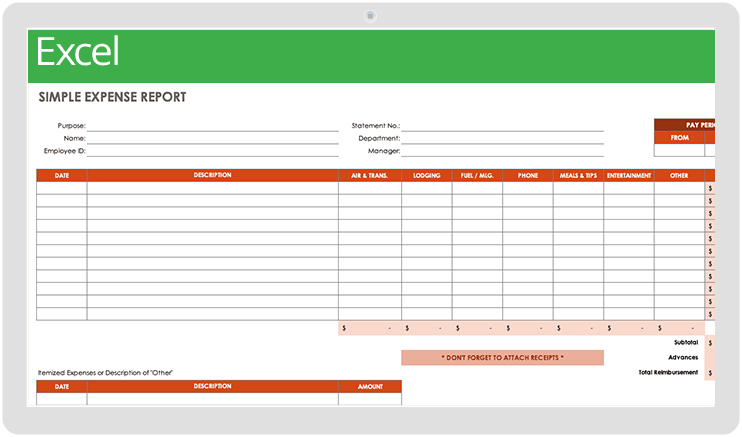

Excel Templates

Excel templates are spreadsheets that you can create and customize yourself using Microsoft Excel. They offer a high level of flexibility and allow you to create complex expense reports with calculations and formulas. However, Excel templates can be time-consuming to create and may require some technical knowledge.

Mobile App Templates

Mobile app templates are designed to be used on smartphones and tablets. They allow you to track expenses on the go and typically include features such as receipt scanning and GPS tracking. Mobile app templates are convenient but may not offer the same level of functionality as desktop templates.

Elements of an Effective Expense Report Template

An effective expense report template streamlines the process of tracking and submitting business expenses. It provides a clear and organized framework that ensures all essential information is captured and presented in a consistent manner. Here are the key elements that should be included in an effective expense report template:

Clear organization and ease of use are crucial for an effective expense report template. The template should be designed with a logical flow of information, making it easy for users to understand and complete. This includes using clear headings, subheadings, and labels, as well as providing sufficient space for detailed entries.

Essential Elements

- Header: The header should include the company name, logo, and the title “Expense Report.”

- Employee Information: This section should include the employee’s name, department, and employee ID.

- Expense Details: This section should include a table with columns for date, description, amount, and category.

- Total Expenses: This section should include the total amount of expenses incurred.

- Approval Section: This section should include a signature line for the employee and the approver.

Customization and Modification of Templates

Customizing and modifying expense report templates is crucial for aligning them with the specific needs of your organization and ensuring they capture all necessary information.

Tips for Tailoring Templates

– Identify Required Fields: Determine the specific data points that are essential for your expense reporting process. This may include details such as vendor name, date of purchase, expense category, and amount spent.

– Streamline Data Entry: Use clear and concise field labels to guide users and minimize errors. Consider implementing drop-down menus or autofill options for frequently used values to streamline data entry.

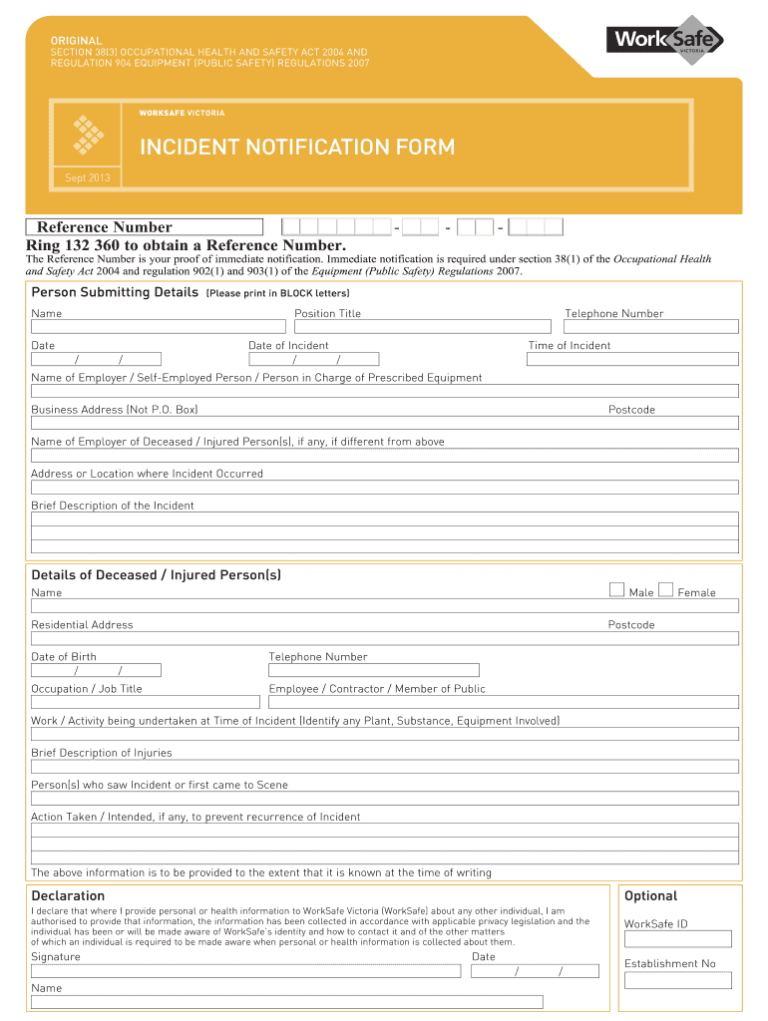

– Enforce Compliance: Ensure that the template aligns with your company’s expense policies and any relevant regulations. This may involve including fields for approval signatures or incorporating validation rules to prevent unauthorized expenses.

– Incorporate Automation: Leverage automation tools to streamline the expense reporting process. For instance, integrate the template with your accounting software to automatically populate certain fields or generate reports.

– Regularly Review and Update: Regularly review and update your expense report templates to ensure they remain effective and meet the evolving needs of your organization.

Implementation and Usage of Templates

Implementing expense report templates is a straightforward process that can streamline your expense reporting workflow.

Integration with Expense Reporting Systems

Most expense reporting systems allow for the integration of custom templates. This enables you to create and manage your own templates within the system, ensuring consistency and efficiency across your team.

By integrating templates, you can:

- Automate expense categorization and coding.

- Enforce expense policies and compliance.

- Generate reports and analytics based on template data.

Examples of Expense Report Templates

Get your hands on a variety of expense report templates to simplify your expense management.

From basic to comprehensive, these templates cater to different business needs and can be customized to suit your unique requirements.

Expense Report Template Showcase

| Template Name | Features | Screenshot |

|---|---|---|

| Basic Expense Report Template | Captures essential expense details, such as date, vendor, amount, and category. | |

| Mileage Expense Report Template | Tracks mileage expenses, including start and end odometer readings, purpose of trip, and vehicle details. | |

| Project-Specific Expense Report Template | Tailored for project-based expenses, allowing you to allocate costs to specific projects or tasks. | |

| International Expense Report Template | Handles expenses incurred during international travel, including currency conversion and foreign exchange rates. |

Best Practices for Expense Report Templates

Designing and using expense report templates effectively requires following best practices. These guidelines ensure accuracy, efficiency, and compliance.

Common Pitfalls to Avoid

* Inconsistent formatting: Templates should maintain a consistent structure and layout to simplify data entry and review.

* Lack of detail: Templates should capture all necessary expense information, including dates, descriptions, amounts, and receipts.

* Insufficient controls: Templates should include built-in controls to prevent fraud and ensure accuracy, such as mandatory fields and validation rules.

* Poor accessibility: Templates should be accessible to all authorized users, regardless of their location or device.

* Limited customization: Templates should allow for customization to meet specific business requirements.

Tips for Optimizing Templates

* Use clear and concise language: Instructions and field labels should be easy to understand.

* Provide examples and guidance: Include examples of completed expense reports to guide users.

* Automate calculations: Use formulas and automation to calculate totals and identify errors.

* Integrate with accounting systems: Link templates to accounting systems to streamline expense processing.

* Regularly review and update: Regularly review templates to ensure they align with business processes and compliance requirements.

Advanced Features and Integrations

Expense report templates can be enhanced with advanced features to streamline expense management processes. These features include:

- Mobile accessibility: Templates can be accessed and filled out on mobile devices, allowing employees to submit expenses on the go.

- Optical character recognition (OCR): OCR technology can automatically extract data from receipts and invoices, reducing manual data entry and improving accuracy.

- Automated expense categorization: Machine learning algorithms can automatically categorize expenses based on s or predefined rules, saving time and reducing errors.

- Integration with accounting software: Templates can be integrated with accounting software to automatically populate expense data into the accounting system, eliminating the need for manual data entry.

- Approval workflows: Templates can be configured with approval workflows, ensuring that expenses are reviewed and approved by the appropriate individuals before reimbursement.

Integrations with Other Tools

Integrating expense report templates with other tools can further enhance their functionality. For example:

- Integration with travel management tools: Templates can be integrated with travel management tools to automatically populate expense data related to flights, hotels, and rental cars.

- Integration with project management tools: Templates can be integrated with project management tools to track expenses associated with specific projects.

- Integration with payroll systems: Templates can be integrated with payroll systems to automatically reimburse employees for expenses.

By leveraging advanced features and integrating with other tools, expense report templates can become a powerful tool for streamlining expense management processes, reducing errors, and saving time.

Legal and Compliance Considerations

Expense reporting is subject to various legal and compliance requirements, such as tax regulations, data privacy laws, and internal company policies. Expense report templates can play a crucial role in ensuring compliance by providing a structured and standardized framework for capturing and documenting expense-related information.

- Tax Regulations: Expense report templates can help ensure that expenses are properly classified and documented in accordance with tax regulations, reducing the risk of errors or omissions that could lead to tax penalties.

- Data Privacy Laws: Templates can assist in protecting sensitive financial and personal data by incorporating security measures and ensuring that data is handled in compliance with applicable privacy laws.

- Internal Company Policies: Templates can align with company policies regarding expense reimbursement, ensuring that employees follow the correct procedures and that expenses are approved and processed efficiently.

FAQs

What are the key elements of an effective expense report template?

Essential elements include clear expense categories, detailed descriptions, supporting documentation, accurate dates and amounts, and an approval section.

How can I customize expense report templates to meet my specific requirements?

Look for templates that allow for customization, such as adding custom fields, modifying categories, or incorporating company branding.

What are the benefits of integrating expense report templates with expense reporting systems?

Integration automates data entry, eliminates manual errors, and provides real-time visibility into expenses, enhancing efficiency and control.