Investment Agreement Templates: A Comprehensive Guide for Investors and Entrepreneurs

Investment agreement templates are indispensable tools for navigating the complex world of investment agreements. These pre-drafted documents provide a solid foundation upon which investors and entrepreneurs can build their agreements, ensuring that their interests are protected and their investments are secure.

In this comprehensive guide, we will explore the different types of investment agreement templates available, the essential clauses they should include, and the legal implications of using them. We will also provide resources for finding reputable templates and share best practices for customizing and adapting them to specific needs.

Introduction to Investment Agreement Templates

Investment agreement templates are pre-drafted legal documents that provide a framework for structuring and documenting investment transactions. They set out the terms and conditions governing the investment, including the rights and obligations of the parties involved.

Using investment agreement templates offers several advantages. Firstly, they save time and effort by providing a starting point for drafting investment agreements. Secondly, they ensure consistency and clarity in the documentation, reducing the risk of misunderstandings or disputes. Thirdly, they help to protect the interests of all parties involved by ensuring that their rights and obligations are clearly defined.

Types of Investment Agreement Templates

Investment agreement templates come in different types, each designed to suit specific investment scenarios. Understanding the key features and differences between these types is crucial for selecting the most appropriate template for your investment needs.

Common types of investment agreement templates include:

- Equity Investment Agreement: Artikels the terms and conditions for an investor to acquire an ownership stake in a company in exchange for funding.

- Debt Investment Agreement: Defines the terms for a loan or debt financing, including interest rates, repayment schedules, and security arrangements.

- Convertible Debt Investment Agreement: Combines features of both equity and debt investments, allowing the investor to convert the debt into equity at a later stage.

- Joint Venture Agreement: Establishes the framework for two or more parties to collaborate on a specific business venture, sharing ownership, profits, and risks.

- Private Placement Memorandum: Provides detailed information about a private securities offering, outlining the investment opportunity, risks, and terms for potential investors.

Essential Clauses in Investment Agreement Templates

Investment agreement templates provide a structured framework for documenting the terms and conditions of an investment. They help ensure that both parties are clear on their rights, responsibilities, and expectations.

There are several essential clauses that should be included in every investment agreement template. These clauses include:

Identification of Parties

This clause identifies the parties to the agreement, including their names, addresses, and contact information. It also specifies the capacity in which each party is acting (e.g., as an individual, a company, or a trustee).

Investment Terms

This clause sets out the terms of the investment, including the amount of the investment, the type of investment (e.g., equity, debt, or convertible debt), and the terms of repayment or redemption.

Representations and Warranties

This clause contains representations and warranties made by each party to the other party. These representations and warranties are intended to provide assurance that each party has the authority to enter into the agreement and that there are no undisclosed facts or circumstances that could affect the validity or enforceability of the agreement.

Covenants

This clause sets out the covenants that each party agrees to comply with during the term of the agreement. These covenants may include restrictions on the use of the investment, obligations to provide financial information, and restrictions on the transfer of the investment.

Conditions Precedent

This clause sets out the conditions that must be satisfied before the investment is made. These conditions may include the receipt of regulatory approvals, the completion of due diligence, or the execution of other agreements.

Termination

This clause sets out the events that may lead to the termination of the agreement. These events may include a breach of a covenant, a material misrepresentation or warranty, or the occurrence of a force majeure event.

Governing Law and Jurisdiction

This clause specifies the governing law and jurisdiction that will apply to the agreement. This is important in the event of a dispute between the parties.

Considerations for Drafting Investment Agreement Templates

Drafting effective investment agreement templates requires careful consideration to ensure clarity, comprehensiveness, and protection of all parties involved. Here are some guidelines to help you craft effective templates:

- Use clear and concise language: Avoid legal jargon and technical terms that may be difficult to understand. Use simple, straightforward language that can be easily interpreted by all parties.

- Be specific and detailed: Clearly Artikel the terms of the investment, including the amount invested, the equity stake acquired, and any conditions or restrictions on the investment.

- Address all relevant issues: Cover all aspects of the investment, including the rights and obligations of the investor and the company, the distribution of profits and losses, and the exit strategy.

- Use consistent formatting: Maintain a consistent structure and format throughout the template to enhance readability and make it easier to navigate.

- Seek legal advice: It’s advisable to consult with an attorney to ensure that the template complies with applicable laws and regulations and protects the interests of all parties.

Common Pitfalls to Avoid

When drafting investment agreement templates, it’s crucial to avoid certain pitfalls that can lead to misunderstandings or disputes. Here are some common pitfalls to watch out for:

- Lack of clarity: Vague or ambiguous language can create confusion and lead to disputes. Use precise and unambiguous language to avoid any room for misinterpretation.

- Incomplete provisions: Failing to address all relevant issues can leave loopholes that may be exploited by one party or another. Ensure that the template covers all aspects of the investment to avoid any potential gaps.

- Unbalanced terms: Investment agreements should be fair and equitable to all parties involved. Avoid drafting templates that favor one party over the other.

- Inconsistent provisions: Contradictory or inconsistent provisions within the template can create confusion and make it difficult to enforce the agreement. Ensure that all provisions are consistent and aligned.

- Lack of flexibility: Investment agreements should be adaptable to changing circumstances. Avoid creating rigid templates that cannot accommodate future changes or unforeseen events.

By following these guidelines and avoiding common pitfalls, you can create effective investment agreement templates that protect the interests of all parties involved and facilitate smooth transactions.

Legal Implications of Investment Agreement Templates

Investment agreement templates offer a convenient framework for structuring investment deals, but it’s crucial to understand their legal implications before using them.

These templates often contain standard clauses that may not fully address the specific needs of your investment. Using a template without seeking legal advice can lead to unintended consequences, potential disputes, and legal vulnerabilities.

Importance of Legal Advice

Consulting a lawyer is essential to ensure that the investment agreement template aligns with your objectives, protects your interests, and complies with applicable laws. A lawyer can:

- Review the template to identify potential risks and gaps

- Negotiate and modify clauses to suit your specific needs

- Explain the legal implications of each clause

- Advise on the tax implications and regulatory considerations

- Draft additional clauses to address unique circumstances

Seeking legal advice can save you time, money, and potential legal complications in the long run.

Resources for Finding Investment Agreement Templates

Finding the right investment agreement template can be a challenge. There are many different sources available, and it can be difficult to know which ones are reputable and which ones are not.

Here are a few tips for finding a good investment agreement template:

- Start by asking your lawyer for recommendations. They will be able to point you in the direction of some reputable sources.

- Do some research online. There are a number of websites that offer free and paid investment agreement templates.

- Attend a seminar or workshop on investment agreements. This is a great way to learn more about the different types of investment agreements and how to find a good template.

Once you have found a few potential sources, it is important to compare them carefully before selecting one.

Here are a few things to consider when comparing investment agreement templates:

- The cost of the template.

- The quality of the template.

- The reputation of the source.

- The terms of the template.

It is important to make sure that the template you select is appropriate for your needs.

Case Studies and Examples of Investment Agreement Templates

Exploring real-world applications and well-crafted templates can provide valuable insights for drafting effective investment agreements.

Investment agreements play a crucial role in outlining the terms and conditions of an investment, ensuring the interests of all parties involved are protected. By examining case studies and examples of successful investment agreement templates, we can gain practical knowledge and best practices for creating our own agreements.

Case Studies

Analyzing case studies of successful investment agreements can reveal the key factors that contribute to their effectiveness. These case studies provide real-world examples of how different types of investment agreements have been used in various industries and contexts.

- Case Study: Venture Capital Investment Agreement – This case study examines a venture capital investment agreement that led to a successful exit for both the investors and the startup company.

- Case Study: Private Equity Investment Agreement – This case study analyzes a private equity investment agreement that enabled a company to expand its operations and achieve significant growth.

- Case Study: Real Estate Investment Agreement – This case study explores a real estate investment agreement that structured the investment and ownership of a commercial property.

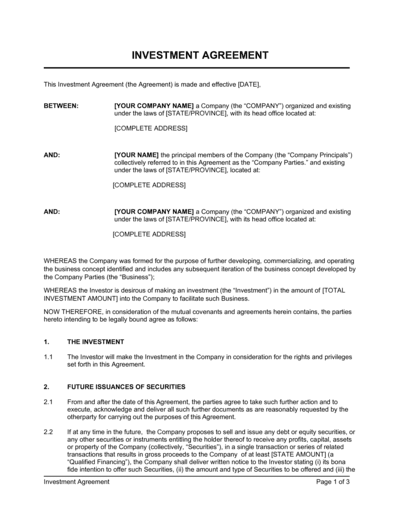

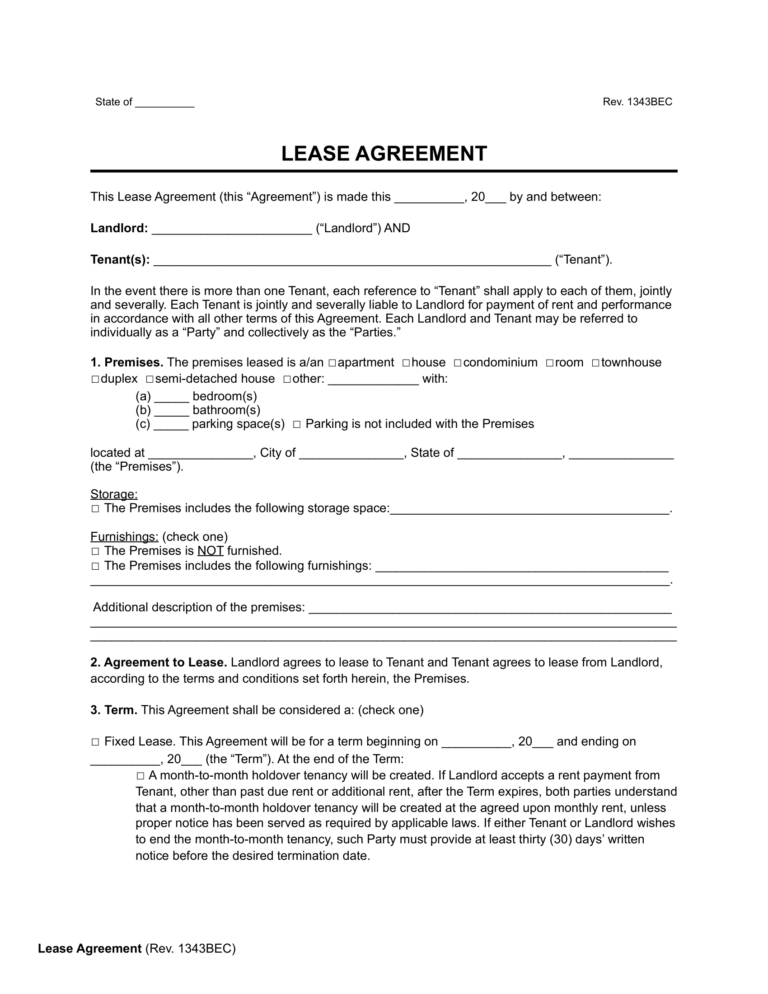

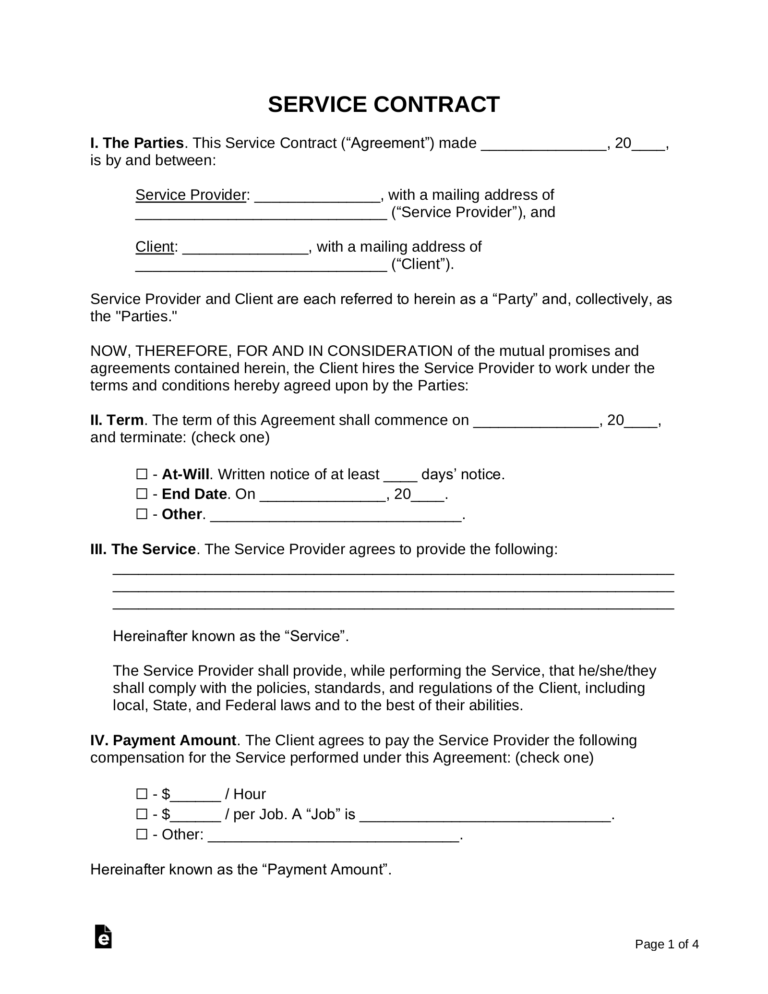

Example Templates

Well-drafted investment agreement templates serve as a starting point for creating tailored agreements that meet specific requirements. These templates provide a comprehensive framework that covers essential clauses and legal considerations.

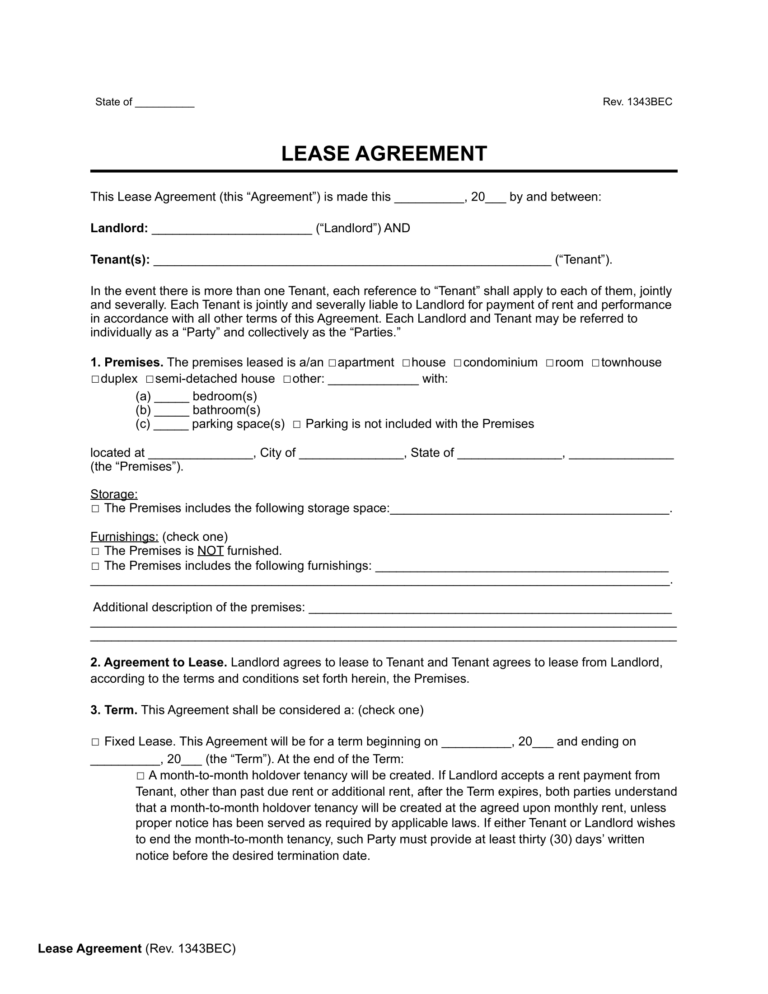

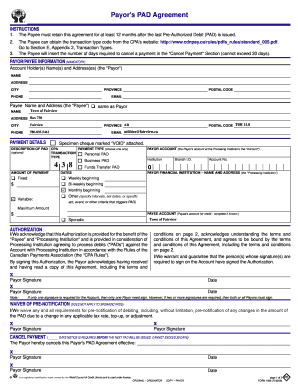

- Template: Convertible Note Agreement Template – This template Artikels the terms of a convertible note, a common financing instrument used by startups.

- Template: Share Purchase Agreement Template – This template provides a detailed framework for the purchase and sale of shares in a company.

- Template: Investment Agreement Template for Angel Investors – This template is specifically designed for angel investors who are seeking to invest in early-stage companies.

Best Practices for Using Investment Agreement Templates

Using investment agreement templates can save time and ensure consistency, but it’s crucial to do it right. Here are some best practices to follow:

First, it’s important to understand the specific needs of your investment agreement. What are the key terms and conditions that need to be included? What are the specific risks that need to be addressed? Once you have a clear understanding of your needs, you can start to customize a template.

Customizing Templates

Don’t just fill in the blanks. Take the time to customize the template to fit your specific needs. This may involve adding or removing clauses, changing the language, or adding specific provisions.

For example, if you’re investing in a startup, you may want to include a provision that gives you the right to convert your investment into equity at a later date. Or, if you’re investing in a real estate project, you may want to include a provision that gives you the right to inspect the property before closing.

Seeking Professional Advice

If you’re not sure how to customize a template, it’s always a good idea to seek professional advice. An attorney can help you to ensure that your agreement is legally binding and that it protects your interests.

Negotiation

Once you have a customized template, you’ll need to negotiate the terms of the agreement with the other party. This is where you’ll need to be prepared to compromise and find a solution that works for both of you.

Remember, the goal of using an investment agreement template is to save time and ensure consistency. But it’s important to remember that no two investments are the same. Take the time to customize the template to fit your specific needs, and don’t hesitate to seek professional advice if you’re not sure how to do it.

Future Trends in Investment Agreement Templates

The landscape of investment agreement templates is constantly evolving, driven by technological advancements, regulatory changes, and shifting investor preferences. Here are some emerging trends and developments to watch for:

Innovative Drafting Approaches: Artificial intelligence (AI) and machine learning (ML) are being used to automate the drafting of investment agreement templates, making them more efficient, consistent, and tailored to specific needs.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are revolutionizing the way investment agreements are executed and enforced. Smart contracts can automate key provisions, reduce transaction costs, and provide greater transparency and security.

ESG Considerations

Environmental, social, and governance (ESG) factors are becoming increasingly important in investment decisions. Investment agreement templates are adapting to incorporate ESG provisions, ensuring that investments align with sustainable practices.

Data Privacy and Cybersecurity

With the growing importance of data in investment transactions, data privacy and cybersecurity are becoming critical considerations. Investment agreement templates are being updated to address data protection, breach notification, and liability issues.

Answers to Common Questions

What is the purpose of an investment agreement template?

An investment agreement template provides a structured framework for outlining the terms and conditions of an investment agreement, ensuring that all relevant aspects are addressed and documented.

What are the benefits of using an investment agreement template?

Using an investment agreement template saves time and effort in drafting agreements, ensures consistency and clarity in the language used, and helps avoid potential legal disputes by addressing key legal considerations.

What are some common types of investment agreement templates?

Common types of investment agreement templates include equity investment agreements, debt investment agreements, joint venture agreements, and shareholder agreements.

What are some essential clauses that should be included in an investment agreement template?

Essential clauses in an investment agreement template typically include provisions related to the investment amount, equity or debt structure, repayment terms, rights and responsibilities of investors and entrepreneurs, and dispute resolution mechanisms.

Is it advisable to seek legal advice when using an investment agreement template?

While investment agreement templates can provide a useful starting point, it is always advisable to seek legal advice to ensure that the agreement is tailored to the specific needs and circumstances of the parties involved and complies with applicable laws and regulations.