M&A Agreement Sample: A Comprehensive Guide to Mergers and Acquisitions

In the ever-evolving landscape of business, mergers and acquisitions (M&A) play a pivotal role in shaping corporate strategies and driving growth. Whether it’s to expand market share, gain access to new technologies, or streamline operations, M&A transactions can be complex and require a solid understanding of the legal framework involved. This guide will provide you with a comprehensive overview of M&A agreements, exploring their types, key provisions, negotiation strategies, and drafting considerations, along with a sample agreement for reference.

From defining the different types of M&A agreements to explaining the intricacies of negotiating and drafting these agreements, we will delve into the nuances of this critical aspect of business transactions. Whether you are a seasoned M&A professional or an entrepreneur embarking on your first acquisition, this guide will equip you with the knowledge and insights necessary to navigate the M&A landscape effectively.

Types of M&A Agreements

Mergers and acquisitions (M&A) agreements are legal contracts that govern the terms of a business combination. There are several types of M&A agreements, each with its own unique characteristics and purposes.

Types of M&A Agreements

The most common types of M&A agreements include:

- Merger agreement: A merger agreement is a contract between two or more companies that combines them into a single entity. The resulting entity can be either the acquirer or the target company.

- Acquisition agreement: An acquisition agreement is a contract in which one company acquires all or a majority of the shares of another company. The acquiring company becomes the parent company of the acquired company.

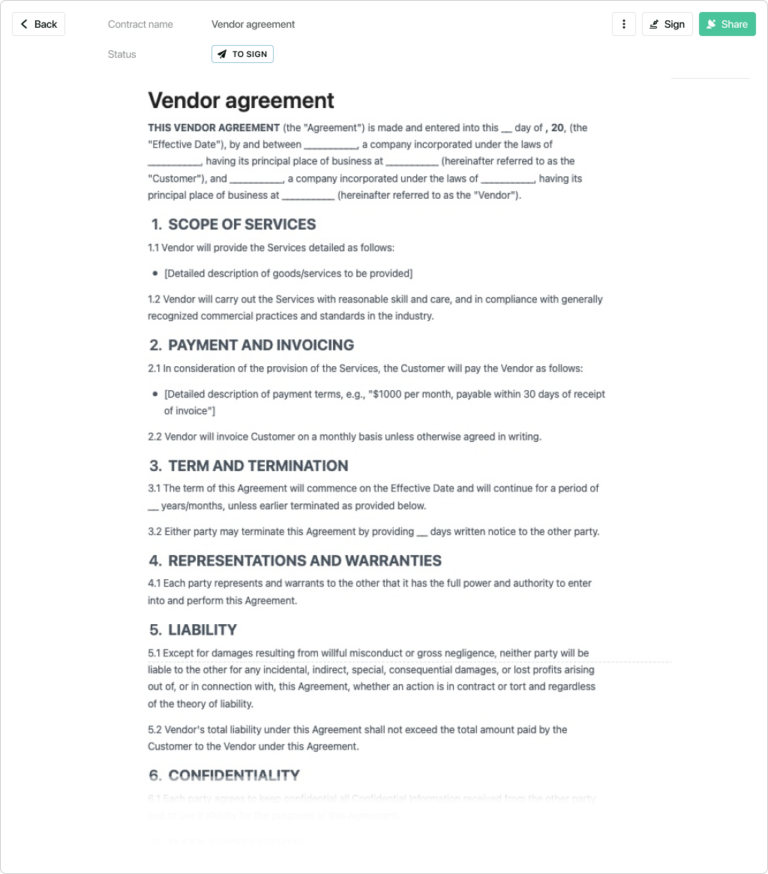

- Joint venture agreement: A joint venture agreement is a contract between two or more companies that creates a new, separate entity for a specific purpose. The joint venture is owned and operated by the participating companies.

- Asset purchase agreement: An asset purchase agreement is a contract in which one company acquires all or a majority of the assets of another company. The acquiring company does not acquire the target company’s liabilities.

- Stock purchase agreement: A stock purchase agreement is a contract in which one company acquires all or a majority of the shares of another company. The acquiring company acquires all of the target company’s liabilities.

Key Provisions of an M&A Agreement

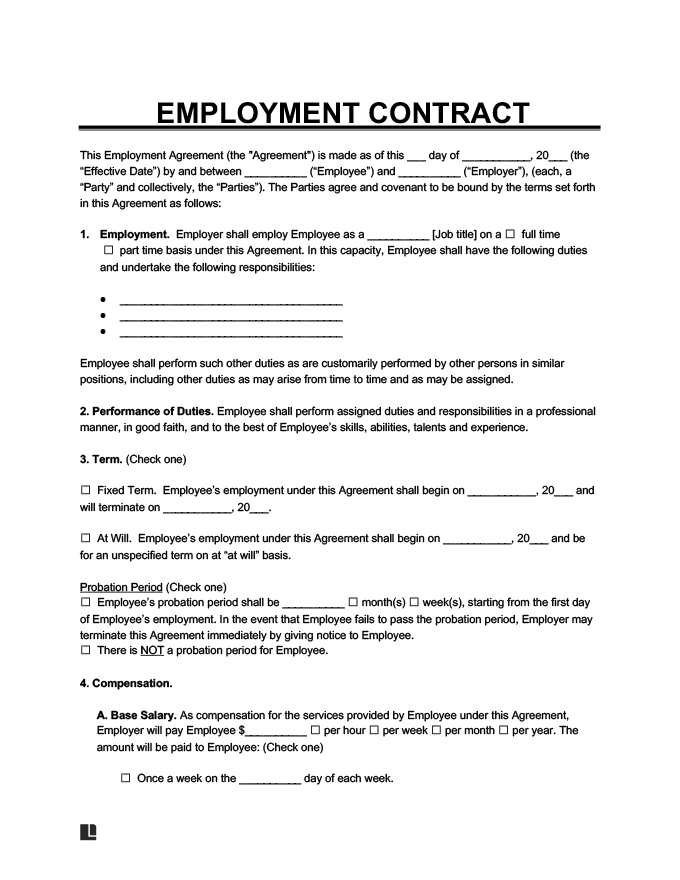

M&A agreements are legally binding contracts that govern the terms and conditions of a merger or acquisition. They are complex documents that cover a wide range of issues, including the purchase price, representations and warranties, covenants, and conditions to closing.

Purchase Price

The purchase price is the amount of money that the acquirer will pay to the target company’s shareholders in exchange for their shares. The purchase price can be fixed or contingent upon certain factors, such as the target company’s financial performance or the achievement of certain milestones.

Representations and Warranties

Representations and warranties are statements made by the target company about its financial condition, legal compliance, and other matters. These statements are designed to provide the acquirer with comfort that the target company is as represented and that there are no hidden liabilities or problems.

Covenants

Covenants are promises made by the target company to do or refrain from doing certain things during the period leading up to the closing of the transaction. These covenants are designed to protect the acquirer’s interests and to ensure that the target company remains a viable business until the transaction is completed.

Conditions to Closing

Conditions to closing are events or circumstances that must occur before the transaction can be completed. These conditions are typically designed to protect the acquirer’s interests and to ensure that the transaction is in the best interests of all parties involved.

Negotiating an M&A Agreement

Negotiating an M&A agreement is a complex process that requires careful planning and execution. There are a number of key issues to consider when negotiating an M&A agreement, including the following:

The purchase price: The purchase price is one of the most important terms of an M&A agreement. It is important to negotiate a fair price that is reflective of the value of the target company. There are a number of factors that can affect the purchase price, including the target company’s financial performance, its industry outlook, and the competitive landscape.

The form of payment: The form of payment is another important term of an M&A agreement. The parties can agree to pay for the target company in cash, stock, or a combination of both. The form of payment can have a significant impact on the tax consequences of the transaction.

The closing conditions: The closing conditions are the conditions that must be satisfied before the transaction can close. These conditions can include regulatory approvals, third-party consents, and the absence of any material adverse change in the target company’s business.

The representations and warranties: The representations and warranties are statements made by the seller about the target company. These statements can be relied upon by the buyer in making its decision to purchase the target company. It is important to negotiate representations and warranties that are accurate and complete.

The covenants: The covenants are promises made by the seller and the buyer. These covenants can include restrictions on the seller’s ability to compete with the target company, obligations to provide the buyer with information, and agreements to cooperate with the buyer in the transition of the business.

Tips for Negotiating a Favorable Agreement

Here are a few tips for negotiating a favorable M&A agreement:

- Be prepared: The more prepared you are for the negotiation, the better your chances of getting a good deal. This means understanding the target company’s business, its financial performance, and its industry outlook.

- Be realistic: Don’t expect to get everything you want in the negotiation. Be prepared to compromise on some issues in order to get what you really want.

- Be creative: There are often multiple ways to structure an M&A transaction. Be creative in your thinking and come up with solutions that meet the needs of both parties.

- Get legal advice: It is important to have an experienced M&A attorney review the agreement before you sign it. An attorney can help you understand the terms of the agreement and protect your interests.

Drafting an M&A Agreement

Bruv, drafting an M&A agreement is like building a fortress – you need to make sure it’s solid and watertight. Let’s break it down, step by step, like a pro.

Key Steps in Drafting an M&A Agreement

- Plan the Heist: Get your team together, scope out the target, and define your goals. You need to know what you’re after and how you’re gonna get it.

- Gather the Docs: Round up all the important bits and bobs, like financials, legal docs, and anything else that’ll help you build your case.

- Draft the Agreement: This is where the magic happens. Write it up in clear and concise language, like a boss. Make sure it covers all the nitty-gritty details, from the purchase price to the closing date.

- Negotiate Like a Pro: It’s time to get your poker face on and negotiate the terms. Remember, it’s all about finding a fair deal that works for both sides.

- Finalize and Sign: Once you’ve hammered out the details, it’s time to put pen to paper (or e-sign these days) and make it official.

Tips for Drafting a Clear and Concise Agreement

Keep it simple, stupid (KISS): Write in plain English that even your nan could understand. Avoid legal jargon and technical terms that might confuse folks.

Be specific: Don’t leave any room for misinterpretation. Spell out exactly what’s expected of each party, like a boss.

Organize it like a pro: Use headings, subheadings, and bullet points to make it easy to navigate. Trust me, your readers will thank you.

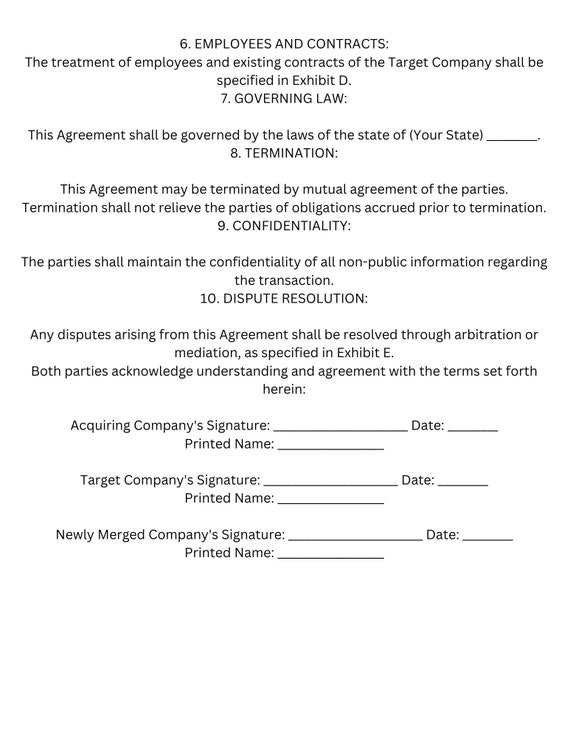

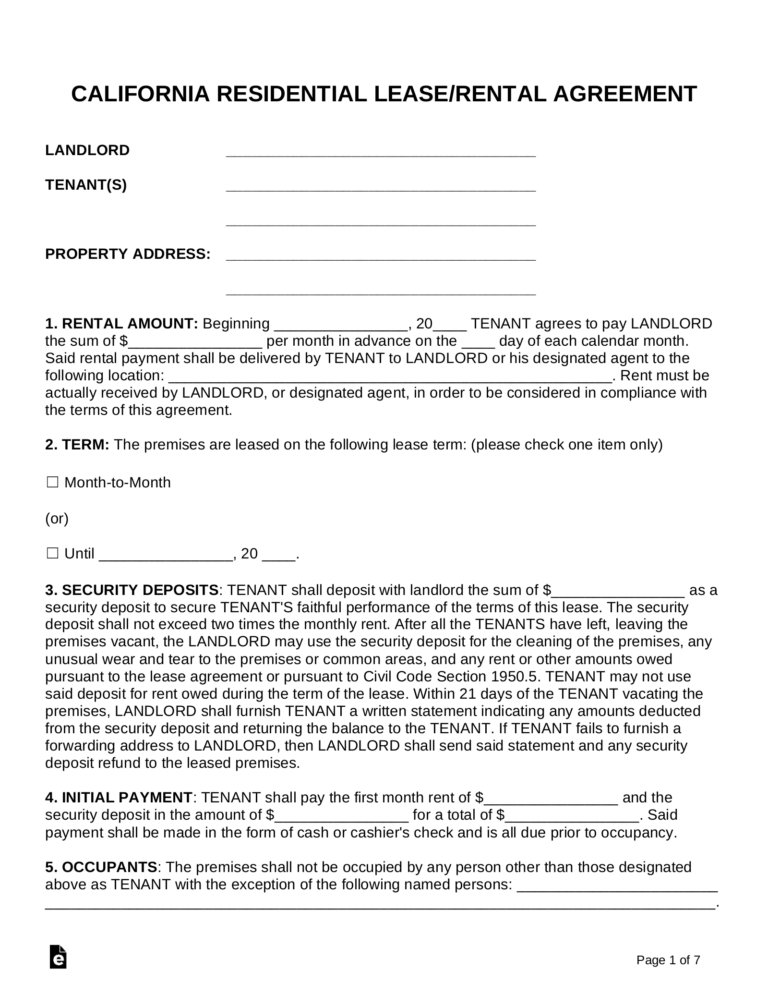

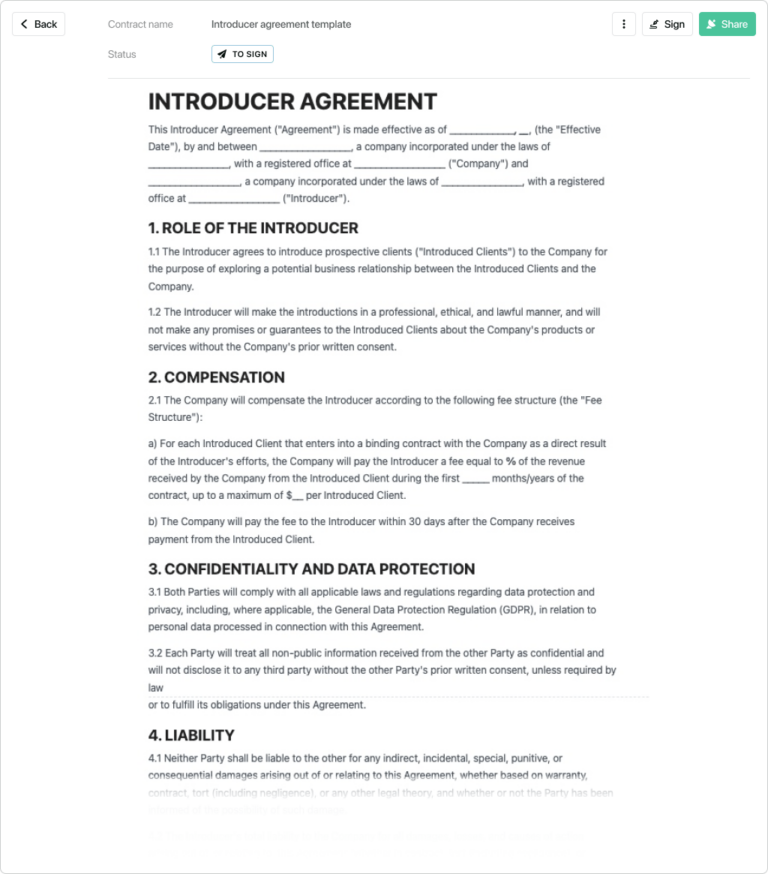

Sample M&A Agreement

A sample M&A agreement is a legal document that Artikels the terms and conditions of a merger or acquisition. It is a binding contract between the two parties involved in the transaction and sets out the rights and obligations of each party.

The key provisions of an M&A agreement typically include:

– The purchase price and the form of payment

– The assets and liabilities that are being acquired

– The representations and warranties of the seller

– The covenants of the buyer

– The conditions to closing

– The termination provisions

Q&A

What is the difference between a merger and an acquisition?

A merger involves the combination of two or more companies into a single entity, while an acquisition is the purchase of one company by another.

What are the key provisions of an M&A agreement?

Key provisions include purchase price, representations and warranties, covenants, and conditions to closing.

What are some tips for negotiating a favorable M&A agreement?

Tips include understanding your objectives, conducting thorough due diligence, and seeking legal advice.

What are the steps involved in drafting an M&A agreement?

Steps include planning, drafting, negotiation, and execution.