Personal Loan Agreement Templates: Your Guide to Safe and Secure Lending

Navigating the world of personal loans can be daunting, especially when it comes to ensuring that both parties are protected. Personal Loan Agreement Templates offer a solution, providing a structured framework for creating legally binding contracts that safeguard the interests of both the lender and the borrower.

In this comprehensive guide, we’ll delve into the intricacies of Personal Loan Agreement Templates, exploring their types, benefits, considerations, and legal implications. By the end, you’ll have the knowledge and confidence to draft effective loan agreements that protect your financial interests.

Understanding Personal Loan Agreement Templates

If you’re thinking of borrowing a personal loan, it’s crucial to get to grips with the agreement template first. These templates Artikel the terms and conditions of the loan, including the amount you’re borrowing, the interest rate, and the repayment schedule. Understanding what’s in the template will help you make an informed decision about whether the loan is right for you.

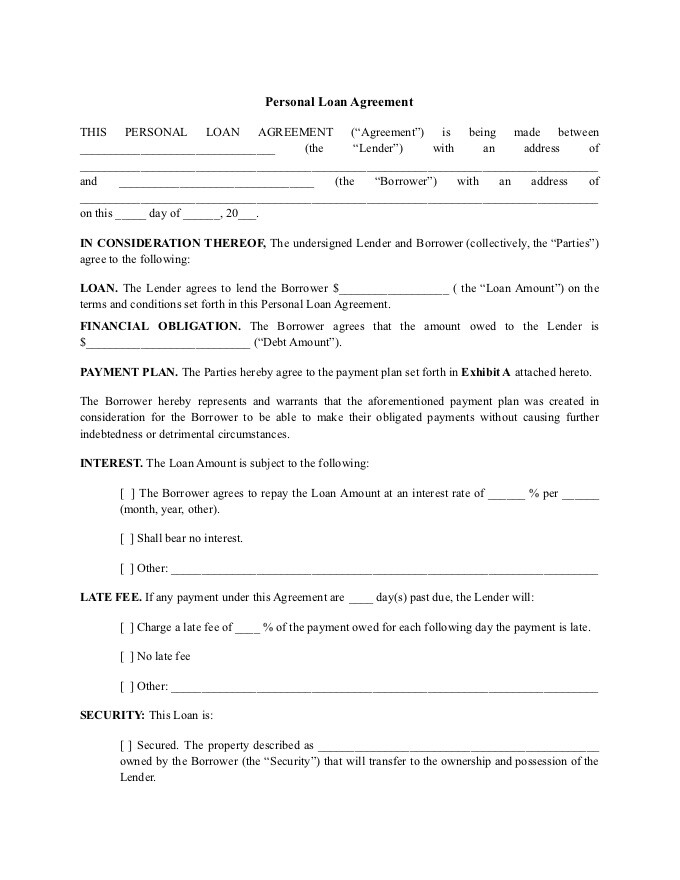

Personal loan agreement templates typically include the following key elements:

- The names and addresses of the borrower and lender

- The amount of the loan

- The interest rate

- The repayment schedule

- The default provisions

- The governing law

These elements are essential to any personal loan agreement template. They ensure that both the borrower and lender are clear on the terms of the loan and their respective obligations.

Here are some examples of standard template clauses:

- “The borrower promises to repay the loan in full, plus interest, on the following schedule:”

- “The lender may declare the loan to be in default if the borrower fails to make a payment when due.”

- “This agreement shall be governed by the laws of the State of California.”

These clauses are just a few examples of the many that may be included in a personal loan agreement template. It’s important to read and understand all of the clauses before signing the agreement.

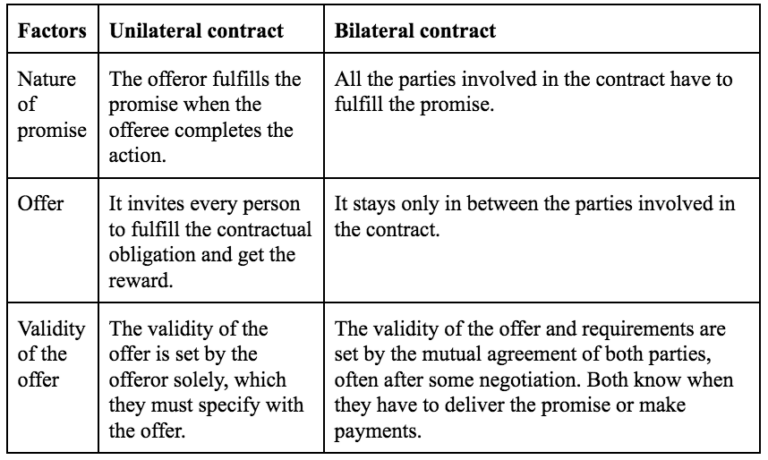

Types of Personal Loan Agreement Templates

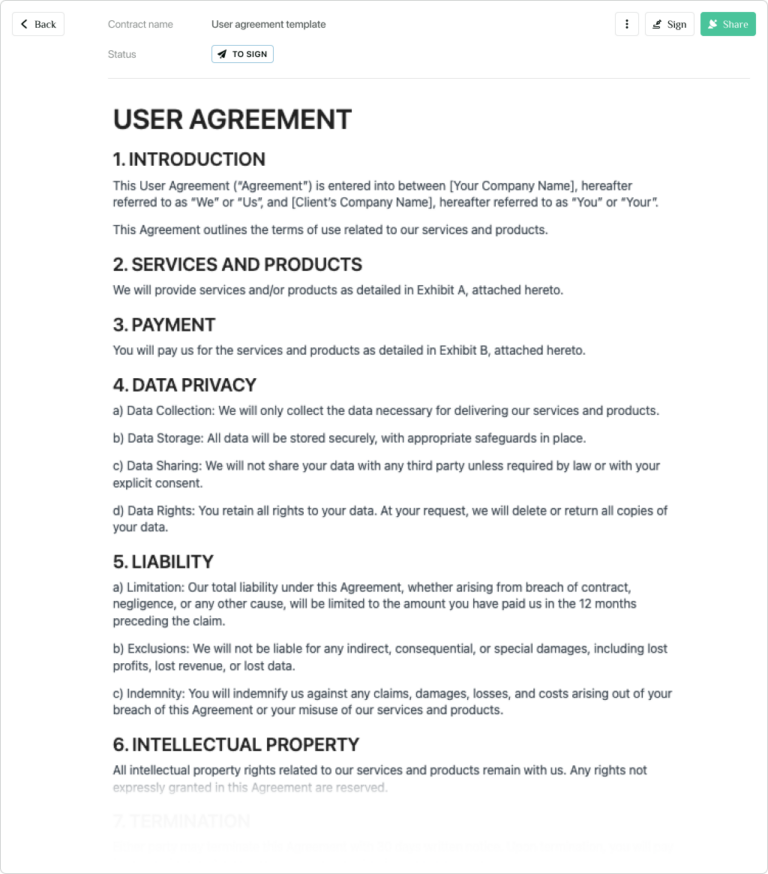

When it comes to getting a personal loan, having a solid agreement in place is crucial. That’s where personal loan agreement templates come in handy. These templates provide a framework for creating a legally binding contract between you and the lender.

But hold up, there’s more than one type of personal loan agreement template out there. Each one has its own unique features and uses. Let’s break it down for you, bruv:

Unsecured Personal Loan Agreement Template

This template is the go-to choice if you’re not putting up any collateral to secure your loan. It’s a straightforward agreement that Artikels the loan amount, interest rate, repayment terms, and any other relevant details.

Secured Personal Loan Agreement Template

If you’re willing to put up some collateral, like your car or a piece of property, you might want to consider a secured personal loan. This template includes provisions for the collateral and the consequences of default.

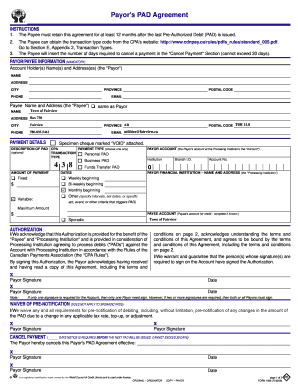

Line of Credit Agreement Template

This template is perfect if you need access to funds on an ongoing basis. It establishes a maximum credit limit that you can draw from as needed, up to a certain point.

Choosing the Right Template

Picking the right personal loan agreement template depends on your specific needs. Consider factors like the loan amount, the repayment terms, and whether or not you have collateral to secure the loan. It’s always a good idea to consult with a solicitor to make sure you understand the terms and conditions before you sign on the dotted line.

Benefits of Using Personal Loan Agreement Templates

Using pre-drafted personal loan agreement templates offers numerous advantages that streamline the loan agreement process and ensure consistency and accuracy in loan agreements.

Streamlining the Loan Agreement Process

Templates provide a standardized framework for creating loan agreements, eliminating the need to draft agreements from scratch. This saves time and effort, allowing lenders and borrowers to focus on the essential details of the loan.

Ensuring Consistency and Accuracy

Templates help ensure consistency in loan agreements, reducing the risk of errors and omissions. They provide a clear structure and predefined clauses that address common legal requirements, minimizing the potential for disputes.

Considerations When Using Personal Loan Agreement Templates

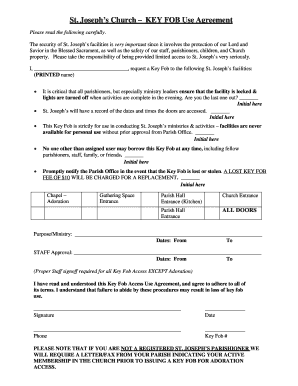

Using personal loan agreement templates offers several advantages, but it’s crucial to be aware of potential drawbacks and limitations. Understanding these considerations will help you make informed decisions and utilize templates effectively.

Importance of Reviewing and Customizing Templates

Personal loan agreement templates provide a solid foundation, but they may not fully align with your specific needs. It’s essential to thoroughly review and customize the template to ensure it accurately reflects your requirements. This includes:

- Verifying the terms and conditions align with your expectations and legal obligations.

- Adjusting repayment schedules and interest rates to suit your financial situation.

- Including any additional clauses or provisions that protect your interests.

Adapting Templates While Maintaining Legal Compliance

When customizing templates, it’s paramount to maintain legal compliance. Ensure that the modified agreement adheres to applicable laws and regulations. This may involve consulting with a legal professional to ensure the template meets your specific requirements while remaining legally sound.

Legal Implications of Personal Loan Agreement Templates

Using personal loan agreement templates has legal implications. It’s crucial to ensure these templates are legally binding and enforceable to protect both the lender and the borrower. To achieve this, consider including the following essential clauses:

Essential Clauses for Legal Validity

- Identification of Parties: Clearly identify the lender and the borrower, including their full names, addresses, and contact information.

- Loan Amount and Terms: Specify the principal loan amount, interest rate, loan term, and repayment schedule.

- Security (if applicable): Artikel any collateral or security provided by the borrower to secure the loan.

- Repayment Obligations: Clearly state the borrower’s obligation to repay the loan, including the due dates and any applicable penalties for late payments.

- Default Provisions: Define the consequences of the borrower’s failure to repay the loan as agreed, such as late fees, default interest, or potential legal action.

- Governing Law and Jurisdiction: Specify the governing law and jurisdiction that will apply to the agreement in case of any disputes.

Best Practices for Using Personal Loan Agreement Templates

Using personal loan agreement templates can be a valuable tool for ensuring that both the lender and borrower are protected. However, there are some best practices that you should follow to ensure that you are using these templates effectively.

Tips for Effectively Using Personal Loan Agreement Templates

- Read the template carefully before using it. Make sure that you understand all of the terms and conditions of the loan agreement before you sign it.

- Negotiate the terms of the loan agreement with the lender. You may be able to get a better interest rate or other terms if you are willing to negotiate.

- Have an attorney review the loan agreement before you sign it. This will help to ensure that the agreement is legally binding and that your interests are protected.

Importance of Seeking Legal Advice

It is always a good idea to seek legal advice before you sign a personal loan agreement. This is especially important if you are not familiar with the terms of the agreement or if you have any questions about your rights and obligations.

An attorney can help you to understand the agreement, negotiate the terms of the loan, and ensure that your interests are protected.

Helpful Answers

What is the purpose of a Personal Loan Agreement Template?

Personal Loan Agreement Templates provide a pre-drafted framework for creating legally binding loan contracts. They streamline the process, ensure consistency, and protect the rights of both parties.

What are the key elements of a Personal Loan Agreement Template?

Key elements include the loan amount, interest rate, repayment schedule, default provisions, and security interests. These elements ensure clarity and enforceability.

What are the different types of Personal Loan Agreement Templates?

There are various templates available, each tailored to specific loan types, such as secured loans, unsecured loans, and loans with co-signers. Choosing the appropriate template is crucial.

What are the benefits of using a Personal Loan Agreement Template?

Templates save time and effort, promote consistency, ensure accuracy, and provide a solid foundation for legally binding agreements.

What are the considerations when using a Personal Loan Agreement Template?

Templates should be reviewed and customized to suit specific needs. Legal compliance is paramount, and seeking professional advice when necessary is recommended.