Printable Credit Dispute Letter Template PDF: Your Guide to Resolving Credit Errors

Credit disputes are an essential part of maintaining a healthy financial profile. Errors or fraudulent information on your credit report can have a significant impact on your ability to secure loans, housing, and even employment. A printable credit dispute letter template PDF provides a structured and effective way to challenge inaccurate or misleading credit information.

This comprehensive guide will walk you through the features of an effective credit dispute letter, provide a step-by-step guide to using a template, and highlight common mistakes to avoid. Additionally, we’ll provide a downloadable version of our printable credit dispute letter template PDF and answer frequently asked questions to empower you in the credit dispute process.

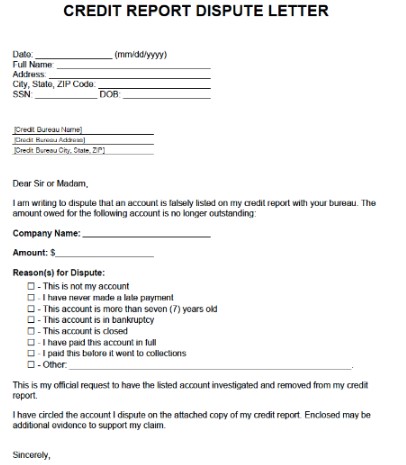

Credit Dispute Letter Template Pdf

If you’ve got a beef with your credit report, you can dispute it with the credit bureau. A dispute letter is a formal way to tell the credit bureau that you don’t think a certain piece of information on your report is accurate. You can use a printable credit dispute letter template to make the process easier.

Here’s what you need to know about writing a credit dispute letter:

First, you need to identify the inaccurate information on your credit report. This could be anything from an incorrect balance to a late payment that you didn’t make. Once you’ve identified the error, you need to gather evidence to support your claim. This could include copies of bills, bank statements, or other documents.

Once you have your evidence, you can start writing your dispute letter. The letter should be clear and concise, and it should include the following information:

- Your name and contact information

- The date

- The name of the credit bureau you’re disputing the information with

- A description of the inaccurate information

- A copy of your evidence

Once you’ve written your dispute letter, you need to mail it to the credit bureau. You can find the address of the credit bureau on their website. Once the credit bureau receives your letter, they will investigate your claim. If they find that the information on your credit report is inaccurate, they will correct it.

Writing a Credit Dispute Letter

Here are some tips for writing a credit dispute letter:

- Be clear and concise.

- Provide specific details about the inaccurate information.

- Include copies of any evidence you have.

- Be polite and respectful.

- Follow up with the credit bureau if you don’t hear back within 30 days.

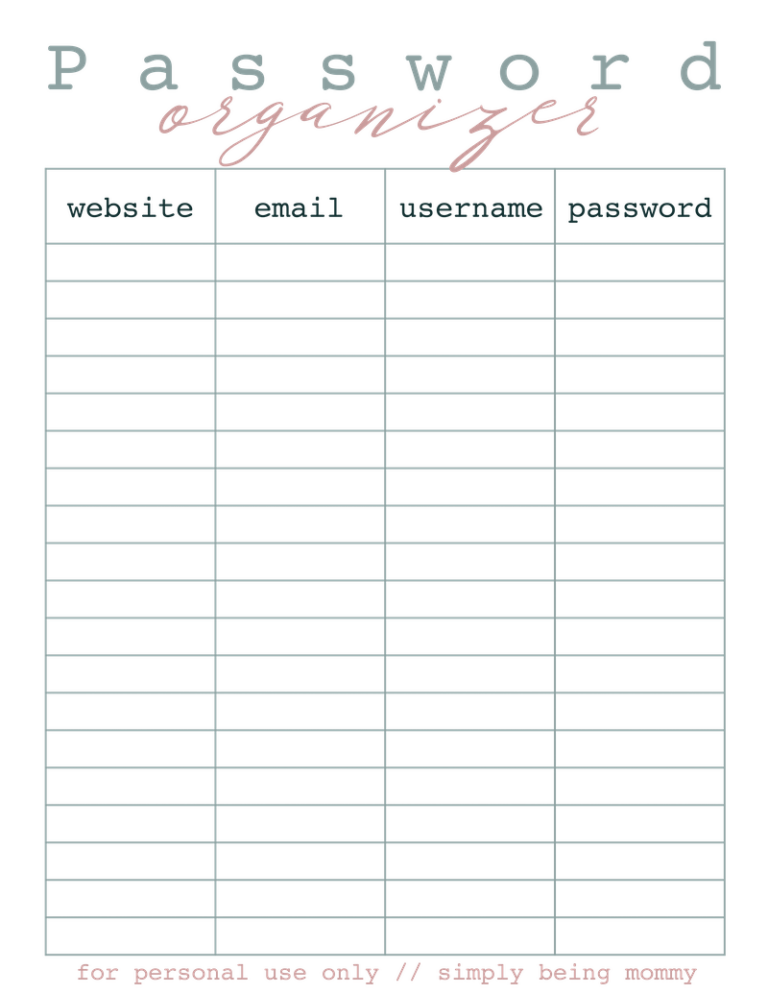

Using a Printable Credit Dispute Letter Template Pdf

If you’re not sure how to write a credit dispute letter, you can use a printable credit dispute letter template. These templates can be found online or at your local library.

Using a template can make the process of disputing inaccurate information on your credit report much easier. However, it’s important to make sure that you fill out the template completely and accurately.

If you have any questions about writing a credit dispute letter, you can contact the credit bureau or a consumer credit counseling agency.

FAQs

What is a credit dispute letter?

A credit dispute letter is a formal communication you send to a credit bureau or creditor disputing inaccurate or fraudulent information on your credit report.

What information should I include in a credit dispute letter?

Your letter should include your personal information, the specific error or fraud you’re disputing, supporting documentation, and a request for correction or deletion.

What are the common mistakes to avoid when disputing credit information?

Common mistakes include providing insufficient evidence, submitting incomplete or inaccurate information, and failing to follow up on your dispute.

Where can I find a printable credit dispute letter template PDF?

You can download a printable credit dispute letter template PDF from the link provided in this guide.