Templates To Dispute Letter On Credit Report: A Comprehensive Guide

Navigating credit reports can be a daunting task, especially when faced with inaccuracies that can negatively impact your financial well-being. Disputing errors on your credit report is crucial for maintaining a healthy financial profile, and utilizing templates can significantly enhance the process.

This comprehensive guide will provide you with essential insights into identifying credit report errors, leveraging dispute letter templates, crafting effective dispute letters, and submitting and tracking your dispute efficiently. Empower yourself with the knowledge to rectify any discrepancies on your credit report and safeguard your financial integrity.

Identifying Types of Credit Report Errors

Credit report errors can be a pain in the neck, innit? They can mess up your credit score and make it harder to get a loan or a new credit card. That’s why it’s important to check your credit report regularly and dispute any errors you find.

There are a few common types of credit report errors to watch out for:

Incorrect or Outdated Information

- Inaccurate account balances

- Missed payments

- Closed accounts that are still being reported as open

- New accounts that you didn’t open

Identity Theft

Identity theft can lead to all sorts of credit report errors, including:

- Fraudulent accounts being opened in your name

- Unauthorized charges on your existing accounts

- Your personal information being used to apply for loans or credit cards

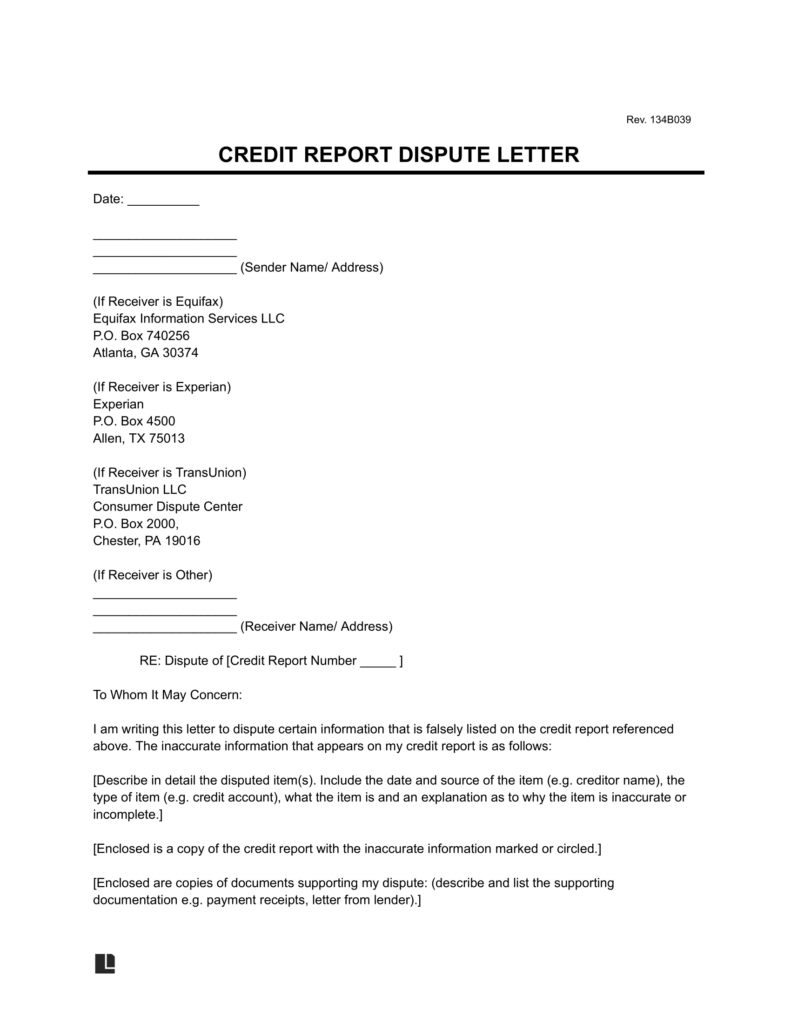

Understanding Dispute Letter Templates

Yo, check it, dispute letter templates are like your secret weapon for fixing those dodgy credit reports. They’re like pre-written blueprints that help you organise your info and slam dunk your case to the credit agencies.

Finding Reputable Templates

Finding decent templates ain’t rocket science. Here’s the lowdown:

- Consumer Financial Protection Bureau (CFPB): The CFPB’s got your back with a template that’s straight from the horse’s mouth.

- Credit Karma: These guys have a user-friendly template that’ll make you look like a pro.

- AnnualCreditReport.com: This official site offers a template that’s like a cheat code for fixing your credit.

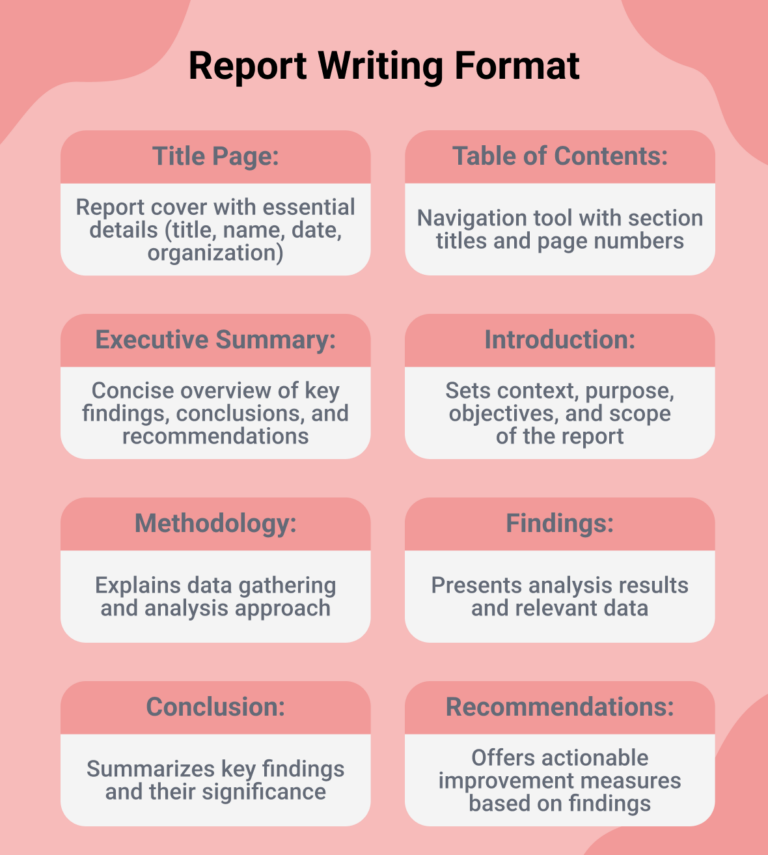

Writing an Effective Dispute Letter

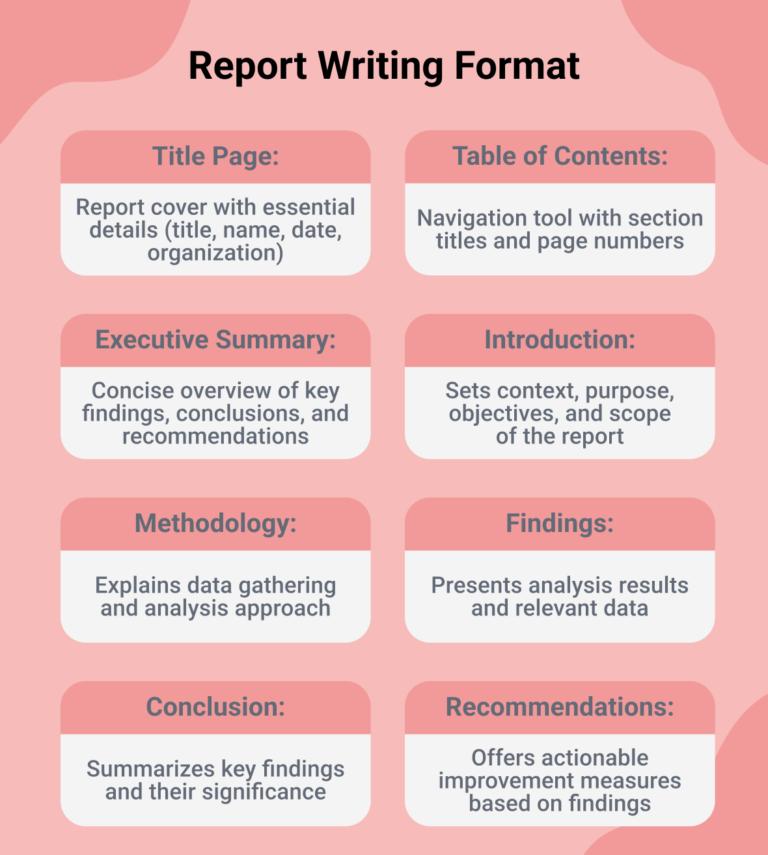

When writing a dispute letter, it’s important to include the right information and follow the correct format to increase your chances of success. Here’s what you need to know:

Key Elements

Make sure your letter includes the following key elements:

- Your personal information (name, address, contact details)

- The account details of the disputed item

- A clear statement of the specific errors you’re disputing

Reasons and Supporting Documentation

For each error you’re disputing, clearly state the reasons why you believe it’s incorrect. If you have any supporting documentation, such as bills, receipts, or statements, be sure to include copies with your letter. This will help to strengthen your case.

Submitting and Tracking the Dispute

Submitting a dispute letter is the first step towards rectifying any errors on your credit report. There are various ways to submit your dispute letter:

- Send your dispute letter via certified mail with a return receipt to ensure delivery and proof of receipt.

Fax

- Fax your dispute letter to the number provided by the credit bureau you are disputing with.

Online Portals

- Many credit bureaus now offer online portals where you can submit your dispute letter electronically.

It is crucial to keep track of the status of your dispute. Credit bureaus are required to respond within 30 days of receiving your dispute. If you do not receive a response within this timeframe, follow up with the credit bureau. You can also check the status of your dispute online or by calling the credit bureau.

If your dispute is not resolved within a reasonable timeframe, you may need to escalate it. You can do this by contacting the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office.

FAQ

What are the most common types of credit report errors?

Incorrect account balances, missed or inaccurate payment history, identity theft, and outdated or unverifiable information.

Where can I find reputable dispute letter templates?

Consumer Financial Protection Bureau (CFPB), Federal Trade Commission (FTC), and credit counseling agencies.

What are the key elements of an effective dispute letter?

Personal information, account details, specific errors being disputed, clear reasons for disputing each error, and supporting documentation.

How long does it take to resolve a credit report dispute?

Typically within 30 days, but can be extended if additional investigation is required.